The government’s new National Semiconductor Strategy provides a clear roadmap for the country’s move up the global technology value chain.

Penang’s Bayan Lepas Free Industrial Zone, home to hundreds of multinational companies, has succeeded because it offers everything these businesses need in one convenient location.

MALAYSIA’S semiconductor industry has been a source of national pride since Intel opened its first overseas assembly plant in Penang in 1972.

Since then, Malaysia has captured a 13% share of global testing and packaging, building a semiconductor industry that now accounts for 25% of gross domestic product.

The vibrant state of Penang is again at the top of the list for semiconductor investments, with dozens of major expansion projects underway.

There is a sense, though, that we are only scratching the surface.

With semiconductors only becoming more important to modern life, Malaysia’s chip sector is not just a business opportunity; it is an opportunity to put the country firmly at the centre of future supply chains in South-East Asia and around the world.

The government’s new National Semiconductor Strategy aims to do just that.

Backed by an initial RM25bil of public funding, the plan provides a clear roadmap for the country’s move up the global technology value chain.

The ambitious targets are a sign that Malaysia understands what’s at stake.

The government aims to attract RM500bil of investment into the sector, train 60,000 chip engineers and establish at least 10 Malaysian companies in design and advanced packaging.

None of this will be easy.

Chip factories and research hubs do not appear overnight.

Just putting a new chip design into production can take up to four months, involving hundreds of steps, including oxidation, photolithography, and etching.

Major new fabs or testing facilities can cost billions of dollars.

But while the new strategy will take time to show results, the stars are aligned in Malaysia’s favour. Businesses must look to seize this moment.

Building on strong foundations

For the best chance of meeting its semiconductor goals, Malaysia can call on a number of tried and tested ingredients.

The first is to acknowledge the power of free trade.

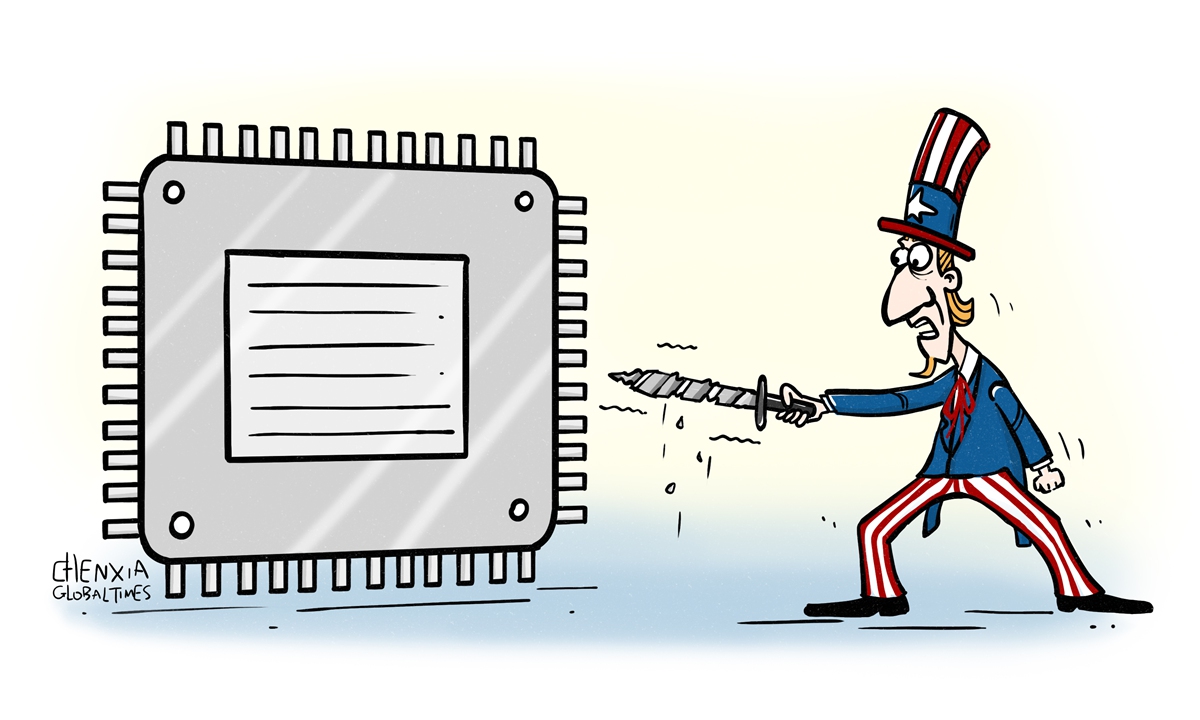

While semiconductor technology is in the geopolitical spotlight, Malaysia’s neutral position on global tariffs is a key part of its appeal to international businesses.

The country’s chip sector has a distinct advantage of being able to attract investment from both the United States and China – as well as many other countries.

Free trade zones are also a powerful pull for semiconductor companies that focus on re-exporting to overseas markets, such as in the outsourced assembly and test segment.

The concentration of skilled labour, specialised logistics and raw materials create an attractive ecosystem for new entrants.

Penang’s Bayan Lepas Free Industrial Zone, home to hundreds of multinational companies, has succeeded because it offers everything these businesses need in one convenient location.

Consistent policies

Consistent and coordinated policies are also critical in giving businesses the confidence they need to make long-term investment decisions.

The new semiconductor strategy ties in with Malaysia’s New Industrial Master Plan 2030, which emphasises the country’s digital infrastructure.

And, of course, sustainability will be a powerful enabler.

International technology companies demand access to clean energy to meet their own emissions objectives, so additional investment in renewable capacity and upgrades to the electricity grid will be needed to sustain the country’s competitiveness.

Collaboration between industry, government and utilities has produced encouraging signs: Intel’s rooftop solar installation in Malaysia is its biggest outside the United States.

Micron’s Malaysian facilities were the first in its global network to be powered by 100% renewable energy.

A historic opportunity

Demand for more advanced processing is also transforming the chip sector, as customers look for specialised hardware to support new technology, including artificial intelligence.

We see across the wider region that high-tech ecosystems generate valuable ancillary business opportunities – such as data centres, services, and advanced materials.

In Penang, a new crop of advanced semiconductor facilities from the likes of Infineon, Intel and ASE Tech will require new materials, new workers and new services.

The new semiconductor strategy recognises the historic opportunity ahead.

We must also acknowledge that it is a complex, globally connected industry, and that international competition for a share of higher-value front-end processes is more intense than ever.

That said, the success of hi-tech hubs like Penang – where HSBC opened its first office in Malaysia in 1884 – is a great example of how a diverse community, strong logistics and a supportive policy framework can facilitate the growth of a multi-billion-dollar industry.

The rewards of getting this right are tantalising.

In the new area of digital technology, semiconductors are only becoming more essential for businesses.

While the prize is significant, achieving it will require a deep partnership between industry and policymakers – underpinned by strategic planning, investment in skills and a commitment to free trade.

With all that in mind, Malaysia’s chip strategy could not have come at a better time.

Noor Adhami is HSBC’s international banking global head and Karel Doshi is HSBC Malaysia’s commercial banking head. The views expressed here are their own.