China's Rise to Economic Superpower

World Economy

As the world still grapples with supply-chain backlogs (partially) caused by China’s strict Covid-19 policies, it has become painfully obvious how vulnerable the global economy is to national or even regional disruptions, especially if they happen in China, the world’s number one supplier of goods.

Over the past few decades, China has grown to become the world’s manufacturing hub and largest goods exporter by a significant margin, turning it from emerging market into economic superpower. According to estimates from the IMF’s latest World Economic Outlook, the country will account for 18.8 percent of the world’s GDP based on purchasing power parity (PPP). That’s up from just 8.1 percent two decade ago, when both the United States and the EU were miles ahead of China’s economic output.

Over the past 20 years, both the U.S. and the European Union have seen their economic superiority challenged, as new powers, such as China, India and others have emerged. While the U.S. saw its share of global GDP decline from 19.8 to 15.8 percent between 2002 and 2022, the EU’s share dropped from 19.9 to 14.8 percent of the same period.

The gap between China, the U.S. and the EU will likely widen over the next few years, as the economic outlook for the latter two is cloudy with a chance of recession, while China is expected to continue growing at mid-single-digit growth rates.

By Felix Richter

China’s economy stands out in global arena

Steady trade: Workers use computer terminals to monitor remote operations at a container port in Tianjin. China has now become a major trading partner for more than 140 countries and regions, with its total trade of goods up 7.7% y-o-y in 2022, topping the world for six consecutive years. — AP

Annual average growth of 4.5% between 2020 and 2022, outpacing the world average of around 2%

BEIJING: In its three-year-long fight against Covid-19, China posted outstanding results in economic development and epidemic control, reinforcing its status as a leading engine for the global economy. From 2020 to 2022, China’s economy posted an annual average growth of 4.5%, outpacing the world average of around 2%, according to Yuan Da, director of the Department of National Economy of the National Development and Reform Commission. In 2022, the economy grew 3% year-on-year (y-o-y) to a record high of 121 trillion yuan (US$18 trillion or RM76.3 trillion), with the increment standing at 6.1 trillion yuan (RM3.8 trillion), equivalent to the economic aggregate of a medium-sized country. It also marks a new and higher level in terms of economic aggregate after the Chinese economy topped the thresholds of 100 trillion yuan (RM62.5 trillion) and 110 trillion yuan (RM68.8 trillion) in 2020 and 2021, respectively – maintaining its position well as the world’s second-largest economy. Analysts attributed the hard-won results to the country’s effective coordination in fighting Covid-19 and its economic fallouts simultaneously. Thanks to effective virus control and timely pro-growth policies, China’s economy has quickly emerged from the epidemic-induced slump and consolidated its recovery momentum for a brighter outlook. To cope with the constantly evolving epidemic situation, China has been dynamically optimising its control measures while enhancing the treatment and vaccination capacity, effectively safeguarding the lives and health of its 1.4 billion population at minimum costs.As of Jan 13, 92.9% of the Chinese population has been fully vaccinated, with more than 90% of people above 60 covered by vaccination. With Omicron much less pathogenic and deadly, China, in December last year, announced ten new measures to lift numerous Covid-19 restrictions. On Jan 8, its management of Covid-19 was officially downgraded from Class A to Class B. Less than one month after the optimisation of Covid-19 response measures in December 2022, China reported declining numbers of fever patients and critical Covid-19 cases as both had passed the peak. In the just-concluded Spring Festival holiday, China’s consumption made a strong comeback. During the week-long holiday, sales revenue of China’s consumption-related sectors rose 12.2% from the same holiday period in 2022. Its cinemas sold 129 million tickets, generating a whopping revenue of 6.76 billion yuan (RM4.2bil), the second highest-grossing to date. Wen Bin, the chief economist with China Minsheng Bank, said that warming demand at home would propel the turnaround in the Chinese economy this year and estimated the country’s full-year gross domestic product growth at around 5.5%. Aside from the overall economic growth, China also made significant headway in maintaining consumer price stability, guaranteeing food and energy security, and improving people’s livelihoods. In 2022, China’s consumer price index grew by 2%, a fraction of the increases reported in the United States, the eurozone and Britain. It is also lower than those of other emerging economies. Amid a global food crisis, the country has secured a bumper harvest for the 19th year in a row, with its grain output at about 686.53 billion kg in 2022, up 0.5% from 2021. A total of 11.86 million, 12.69 million, and 12.06 million new urban jobs were created in 2020, 2021, and 2022, respectively, all surpassing the targets set for each year. Despite the gloomy global investment environment, China remains one of the most attractive investment destinations in the world. Foreign direct investment in the Chinese mainland, in actual use, expanded 6.3% y-o-y to 1.23 trillion yuan (RM768.8bil) in 2022. China has now become a major trading partner for more than 140 countries and regions, with its total trade of goods up 7.7% y-o-y in 2022, topping the world for six consecutive years.Recently, multiple international investment banks and financial institutions, including Morgan Stanley, Goldman Sachs, HSBC, Barclays, and Natixis, have upwardly revised their forecast for China’s economic growth rate in 2023, betting on the country’s rosy prospects and strong resilience. — Xinhua

Global Economic Prospects report: Sharp, Long-lasting Slowdown to Hit Developing Countries Hard

Piloting spaceship Earth in the new year 2023

.jpeg)

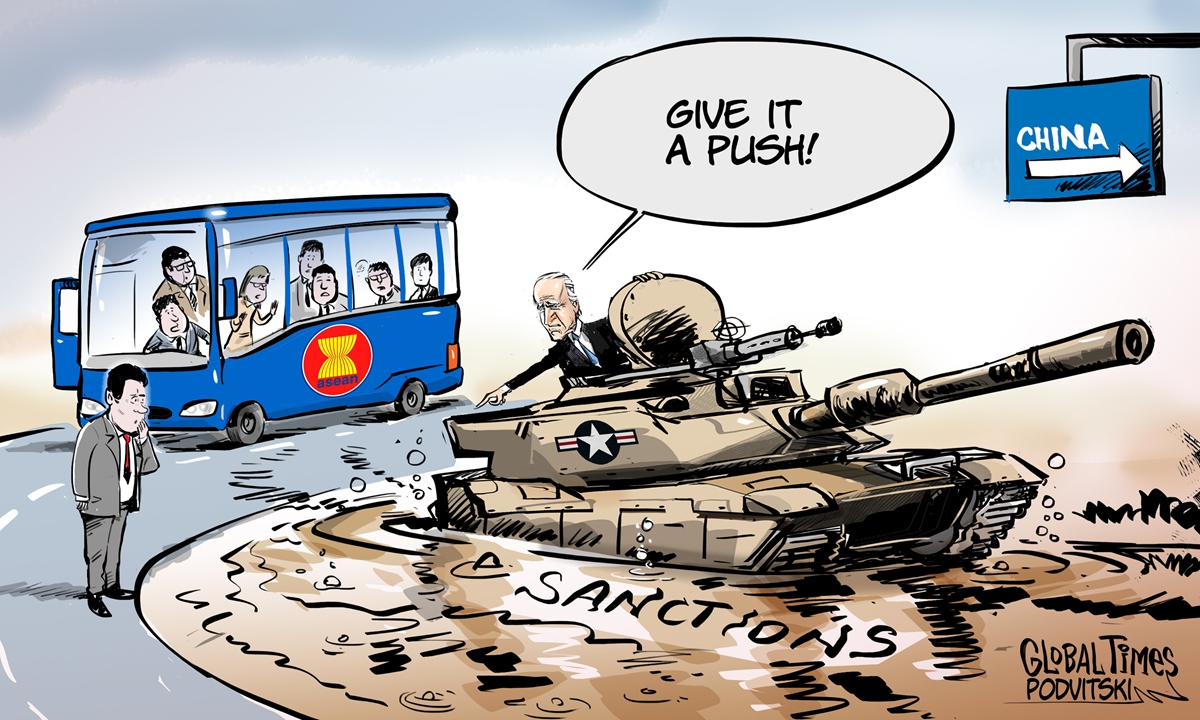

Economic solidarity: Asia-Pacific leaders attending the fourth RCEP meeting as part of the 37th Asean Summit in Hanoi, Vietnam, last week. — Reuters

Economic solidarity: Asia-Pacific leaders attending the fourth RCEP meeting as part of the 37th Asean Summit in Hanoi, Vietnam, last week. — Reuters