rds on display at NRD.

With a single card, individuals can confirm their Malaysian citizenship and seamlessly handle daily tasks such as paying toll, using public transport and buying essentials.

Efficient and convenient – that’s how several users describe their experience using MyKad in daily life.

Some are even updating their MyKad to ensure they have access to the one-off RM100 cash aid given out by the government for the purchase of essentials from Aug 31 in conjunction with National Day.

“I don’t need to carry multiple cards in my wallet.

“MyKad is enough,” said trader Roslina Daud, who uses it as an alternative Touch ‘n Go (TNG) payment method for tolls and parking fees.

Private sector worker Maisara Abdul, who uses public transport to commute to work, said the My50 pass integrated with MyKad was convenient as she no longer needed to carry multiple travel passes for different modes of transport.

Sumbangan Asas Rahmah (Sara) aid recipient Rohani Abdullah welcomed the use of MyKad as a payment method for basic necessities, saying it helps reduce the risk of loss or theft.

“With MyKad, Sara recipients like me do not need to queue at banks or automated teller machines (ATMs) to withdraw money.

“We can go directly to the supermarket, pick up essential items and pay using MyKad,” she said.

History of MyKad

MyKad, or Government Multipurpose Identity Card, was introduced in 2001.

Its goal was to modernise the national identity system, enhance identity security and offer a digital platform that integrates multiple applications into a single card.

Commenting on MyKad’s evolution over more than two decades, National Registration Department (NRD) director-general Badrul Hisham Alias said four versions had been introduced, with the latest launched in 2012.

However, the department is now in the final phase of developing a new MyKad version with enhanced security features.

“The first version used plastic before being upgraded to Polikad 2.0, followed by the current version, which includes additional features like a ‘ghost image’ to improve security.

“Overall, MyKad underwent major changes in 2012 to keep up with technological developments, including design, security features and chip technology,” he said in an interview with Bernama.

Explaining the meaning behind the term “MyKad”, he said “My” referred to Malaysia, while “Kad” meant identification card – its main function being to identify all Malaysian citizens.

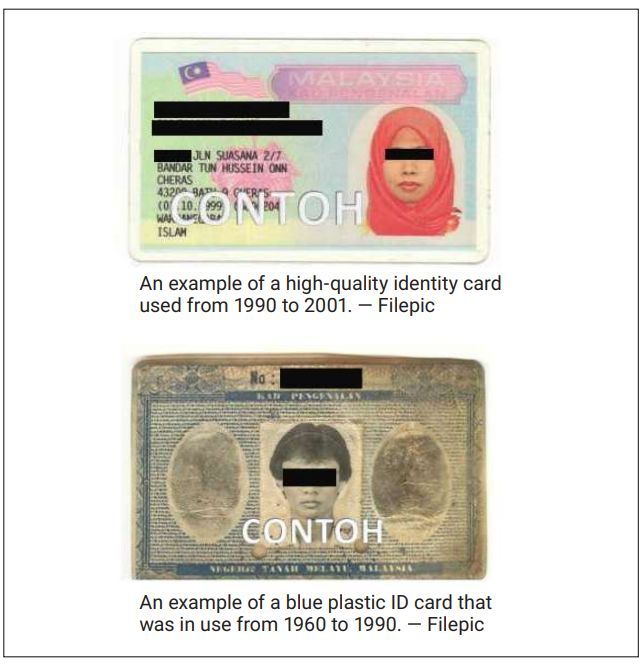

“MyKad is the continuation of the country’s identity document (ID) system, which started with paper cards (1948-1960), then blue plastic ID cards (1960-1990), followed by the hibiscus cards (high-quality IDs from 1990-2001) and now, the modern MyKad,” he said.

Although not fully digital, MyKad is designed to support various government transactions and services by integrating digital applications like driving licences, international passport information, basic health data and e-wallets.

“MyKad is widely used in Malaysia’s public healthcare sector, especially for managing medical records, vaccinations and access to public hospital services through identity verification.

“We have also collaborated with agencies like Inland Revenue Board (LHDN) and Employees Provident Fund (EPF) to improve the effectiveness of financial aid delivery,” he said.

Security features

On public concerns about MyKad’s security, especially if it becomes more widely used, Badrul Hisham said the latest card version contained a chip with built-in security features.

“This chip can only be read, written and recorded by NRD’s approved systems.

“While the chip is also used in other industries, its usage in MyKad is tightly controlled,” he explained.

Visible security features include the “ghost image” using laser engraving technology and enhanced smart chip capacity.

While chip card readers are widely available in the market, only NRD-approved devices can access MyKad data.

Badrul Hisham said data sharing with other agencies like LHDN, Road Transport Department (JPJ), police, Health Ministry and others was conducted securely under a “whole-of-government” approach.

He noted that the MyKad chip was equipped with security keys to prevent unauthorised data access or misuse.

“MyKad data can only be accurately accessed using card readers programmed with specific command sets supplied by certified vendors.

“Fingerprint data is encrypted and requires matching keys for access.

“Any information update can only be done at NRD counters through a card replacement process,” he explained.

Badrul Hisham added that data sharing was regulated and must be approved by the NRD director-general.

“This sharing is only allowed for specific purposes, like improving public services, policy development or research – all while ensuring data confidentiality and security,” he said.

Regarding the risk of MyKad forgery or data cloning, he said the card was designed according to international standards and was very difficult to forge.

“Security features exist on multiple layers of the card, with some requiring special tools for verification.

“This makes MyKad, especially the chip, very hard to counterfeit,” he said.

Role in aid

Currently, MyKad is used to distribute financial aid such as Sumbangan Tunai Rahmah (STR), Sara and eKasih.

Sara, for example, involves 5.4 million recipients using aid from the Finance Ministry to purchase items from 14 categories at participating outlets.

On the perception that Sara funds are “loaded” into MyKad, Badrul Hisham clarified that no money was credited to the card itself.

Instead, recipients’ data is accessed through the store’s system during transactions.

“At participating stores, simply present your MyKad.

“Once your ID number is entered, your name will appear and you can shop based on your allocated aid amount,” he said, adding that the system also showed the remaining balance.

“For the RM100 Sara aid announced by Prime Minister Datuk Seri Anwar Ibrahim, recipients only need to present their MyKad to the cashier for identity verification,” he said.

Badrul Hisham stressed that the aid redemption could not be delegated to another individual.

“It is important to remember that MyKad cannot be held or used by others, including family members, in accordance with Regulation 25(1)(e) of the National Registration Regulations 1990,” he said.

Violators may face up to three years in prison, a fine of up to RM20,000, or both.

Badrul Hisham acknowledged that NRD’s initial goal to make MyKad a multi-purpose platform had yet to be fully realised, despite it being in place for 24 years.

Interest from government agencies in using MyKad as a core service delivery platform has also waned.

He said the latest MyKad version could support digital applications for payments, health records and banking, because of its increased chip capacity – 124KB or 128KB compared to the previous 84KB.

“But many agencies have stopped using MyKad in their systems – like JPJ.

“Otherwise, we would not need to carry a physical driver’s licence; MyKad would suffice.”

Physical vs digital

Commenting on MyDigital ID and MyKad, Badrul Hisham said the physical MyKad was governed by the National Registration Act 1959 and would remain relevant despite MyDigital ID implementation.

NRD is committed to ensuring MyKad remains a robust and relevant identity document, aligned with technological progress and public needs, he said.

In the future, he added, MyKad would not only serve as a physical ID, but also as a key to Malaysia’s digital ecosystem, integrating government, financial, healthcare and social services into one secure, efficient and accessible platform.

“Even in other countries with digital systems, physical ID cards still play a role.

“Our goal is to provide fully end-to-end services, including digital services.”

To support this, NRD is in the process of amending the National Registration Act to enable digital applications via MyKad.

Dr Umi Hamidaton Mohd Soffian Lee, a senior lecturer from the Economics and Muamalat Faculty at Universiti Sains Islam Malaysia (USIM) said MyKad remained crucial in the distribution of aid and subsidies.

“MyKad serves as an integrated database, enabling the government to identify target groups for aid distribution and targeted subsidies based on the profile contained in the MyKad, which includes information such as individual and household income, records of government aid received such as STR and Sara, and number of dependants,” she said.

Citing the example of implementing targeted subsidies for petrol, she said using MyKad was more efficient as the card’s security features could prevent duplication.

“However, if the government intends to implement targeted petrol subsidies via MyKad scanning in the future, it is advisable to first enhance information and digital technology infrastructure in rural areas,” she said.

Umi Hamidaton also recommended that the quality of MyKad continue to be improved, noting that incidents still occurred where the security chip could not be read and the card itself broke easily.

Blockchain enhancement

Blockchain technology can improve MyKad’s security and transparency by storing data in immutable digital ledgers, enabling full audit trails for each access and using cryptography for secure identity verification.

Dr Nor Alina Ismail, Data Science and Computing Faculty head at Universiti Malaysia Kelantan (UMK), said blockchain could ensure better data integrity through permanent records, cryptography and transparent verification across networks – making manipulation or hacking very difficult.

“Unlike centralised systems that are vulnerable to breaches and data loss, blockchain offers distributed storage and real-time audit trails, ideal for sensitive data like health records and digital identity if combined with strong privacy protection mechanisms,” she explained.

She said MyKad could be enhanced into a digital identity wallet through blockchain, integrating personal data like e-wallets, digital certificates, driving licences, health records and ID data securely in a single chain of identity.

She added that zero-knowledge proofs could allow verification of status – such as citizenship or age – without disclosing the full data, improving privacy.

The technology also enables cross-sector use (government, banking, healthcare, education and transport) through shared ledgers and automated smart contract verification.

“For instance, when applying for a bank loan, the bank can verify ID through NRD and employment status via EPF or LHDN without needing physical documents.

“This access can also be restricted via permissioned blockchain and logged for auditing, making processes more efficient and less prone to fraud while giving users full control,” she said.

However, for full implementation, a legal framework, stable digital infrastructure and strong privacy protection are required.

Anticipating that MyKad will evolve into a fully digital identity system within five to 10 years, Nor Alina said Malaysia could emulate countries like Estonia, which had a comprehensive digital identity system.

But, she acknowledged that building a blockchain-based MyKad system would require large government investment in technology, digital infrastructure upgrades, long-term maintenance and training.

“The main challenge is the high initial cost due to upgrading current systems, bridging the digital divide, enhancing existing laws, drafting new ones and developing a comprehensive cybersecurity policy,” she said.

“However, this transformation depends on the readiness of digital infrastructure, the legal framework, public technological literacy and data security assurance.

“Therefore, in this decade, we may see a hybrid approach, where MyKad exists in both physical and digital forms before fully transitioning to a blockchain-based digital identity once the nation’s technological and legal ecosystem is truly ready,” added Nor Alina.