Update Online petition for Fort Detrick probe draws 20m signatures; China urges US to open UNC lab, disclose military games patients...

China says 'no' to US smears over COVID-19 as nearly 10 million from 5 million Chinese...

An open letter demanding that the World Health Organization (WHO)

investigate Fort Detrick has garnered nearly 9.5 million signatures

...

China says 'no' to those in the US who have used the COVID-19 issue to smear China, as their practice revealed their disregard for common sense and arrogance towards science, the Chinese Foreign Ministry said on Friday, after the White House said the US was disappointed by China rejecting the World Health Organization's (WHO) latest COVID-19 origins study plan.

5 million Chinese sign open letter asking WHO to investigate Fort Detrick, a ‘collective will’ that can’t be ignored

Over 5 million Chinese netizens had signed an open letter as of Wednesday demanding the World Health Organization (WHO) investigate the US' Fort Detrick lab over COVID-19 origins. With the number still increasing, Chinese experts and officials consider it a vivid reflection of the collective will of the Chinese public, signaling the outrage toward some US officials who politicized the epidemic to shift the blame and who owe the world an explanation on US own flaws.

Over 5 million Chinese netizens had signed an open letter as of Wednesday demanding the World Health Organization (WHO) investigate the US' Fort Detrick lab over COVID-19 origins. With the number still increasing, Chinese experts and officials consider it a vivid reflection of the collective will of the Chinese public, signaling the outrage toward some US officials who politicized the epidemic to shift the blame and who owe the world an explanation on US own flaws.

`

A group of Chinese netizens drafted the open letter to ask the WHO to investigate the US Army Medical Research Institute of Infectious Diseases (USAMRIID) at Fort Detrick, Maryland, and entrusted the Global Times with posting the letter on its WeChat and Weibo platforms on Saturday to solicit public response. It has gathered more than 5 million signatures as of the press time on Wednesday.

`

Investigating Fort Detrick is the call of people all over the world, including the Chinese people and it is a question that the US must answer when it comes to COVID-19 origins and a problem it can never circumvent, Chinese Foreign Ministry said on Wednesday.

`

In less than five days, about 5 million Chinese have signed the open letter, Chinese Foreign Ministry spokesperson Zhao Lijian said at Wednesday's media briefing. The rising numbers are a representation of the anger of the Chinese people at the political manipulation by some in the US on COVID-19 origins, he noted.

`

To prevent the next outbreak, laboratories studying dangerous viruses and even biological weapons should be put into the focus of the WHO, the letter said.

`

The Fort Detrick lab, particularly, stores the most deadly and infectious viruses in the world, including Ebola, smallpox, SARS, MERS and the novel coronavirus. The leak of any of them would cause severe danger to the world, which also aroused the concerns and doubts about whether the SARS?CoV?2 virus that triggered the global pandemic is related to the lab, it said.

`

The letter was issued as the WHO on Friday proposed a second phase of studies into the origins of the coronavirus in China, including "audits of laboratories and markets in Wuhan," calling for "transparency" from authorities, shortly after WHO head Tedros Adhanom Ghebreyesus appeared to succumb to the US-led West's multiple layers of political pressure, calling on China to be transparent and open in further COVID-19 origins studies, according to observers.

`

Li Haidong, a professor at the Institute of International Relations at China Foreign Affairs University, told the Global Times on Wednesday that so many Chinese people signed the open letter, reflecting the true opinion of ordinary Chinese. "Over the past year, some US politicians have been slandering China on the question of COVID-19 origins, which triggered dissatisfaction among Chinese people. Such public opinion should not be ignored by the international community," Li said.

GT

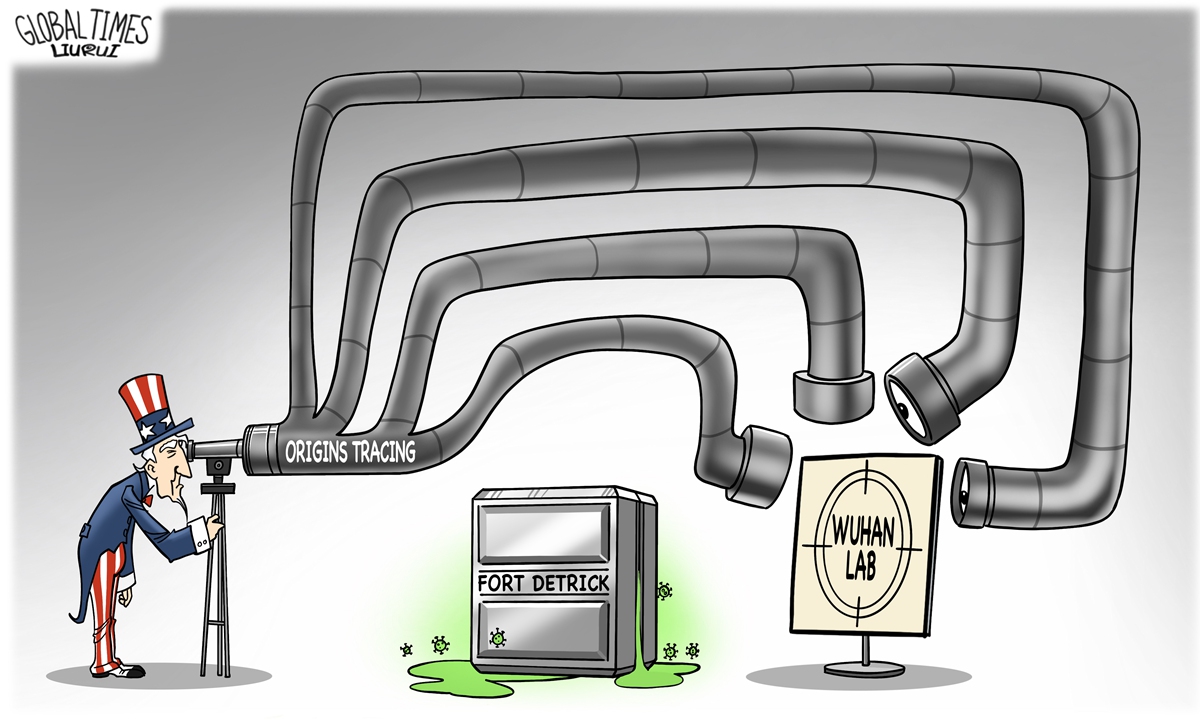

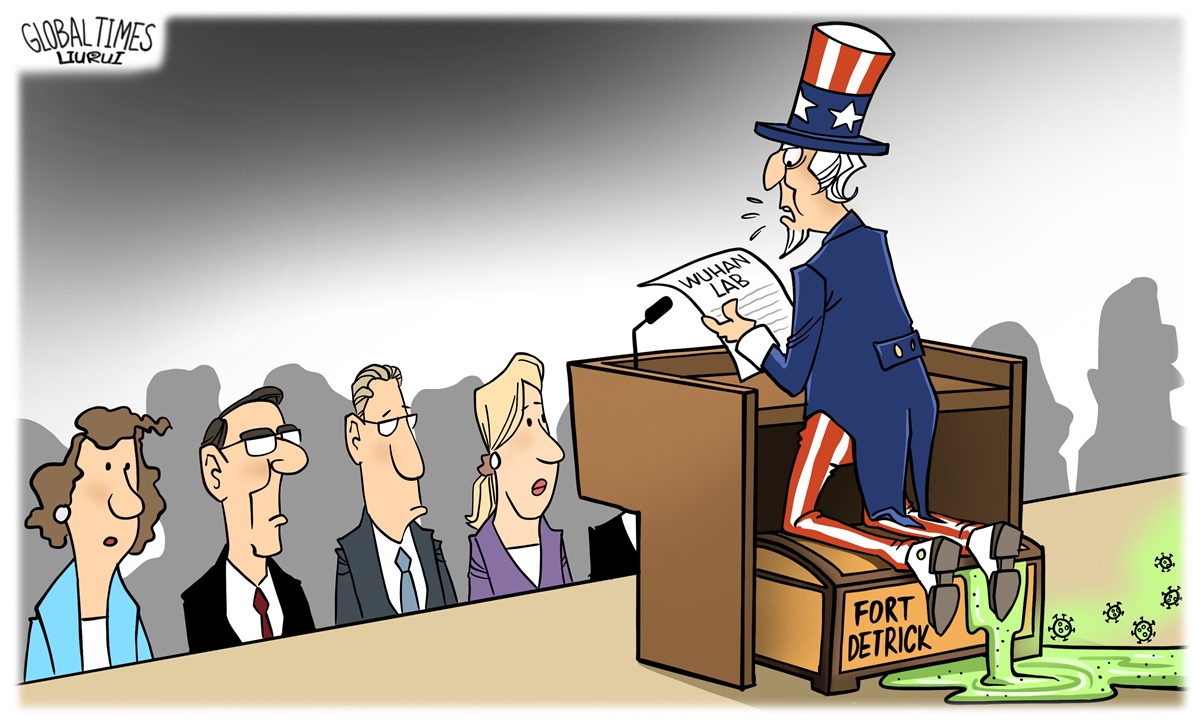

Illustration: Liu Rui/GT

`

US owes the world answers

`

In July 2019, the US CDC issued a "cease and desist order" to halt most research at Fort Detrick. Although this mysterious lab reported the reason for the closure as "ongoing infrastructure issues with wastewater decontamination," the explanation was not persuasive enough for many.

`

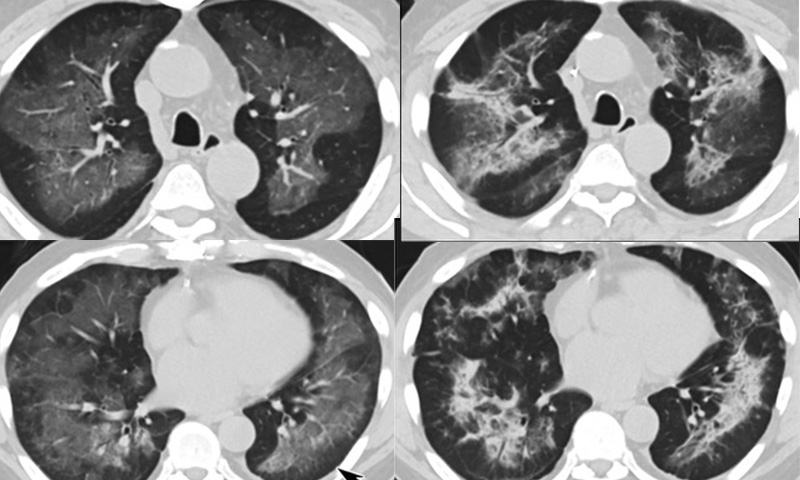

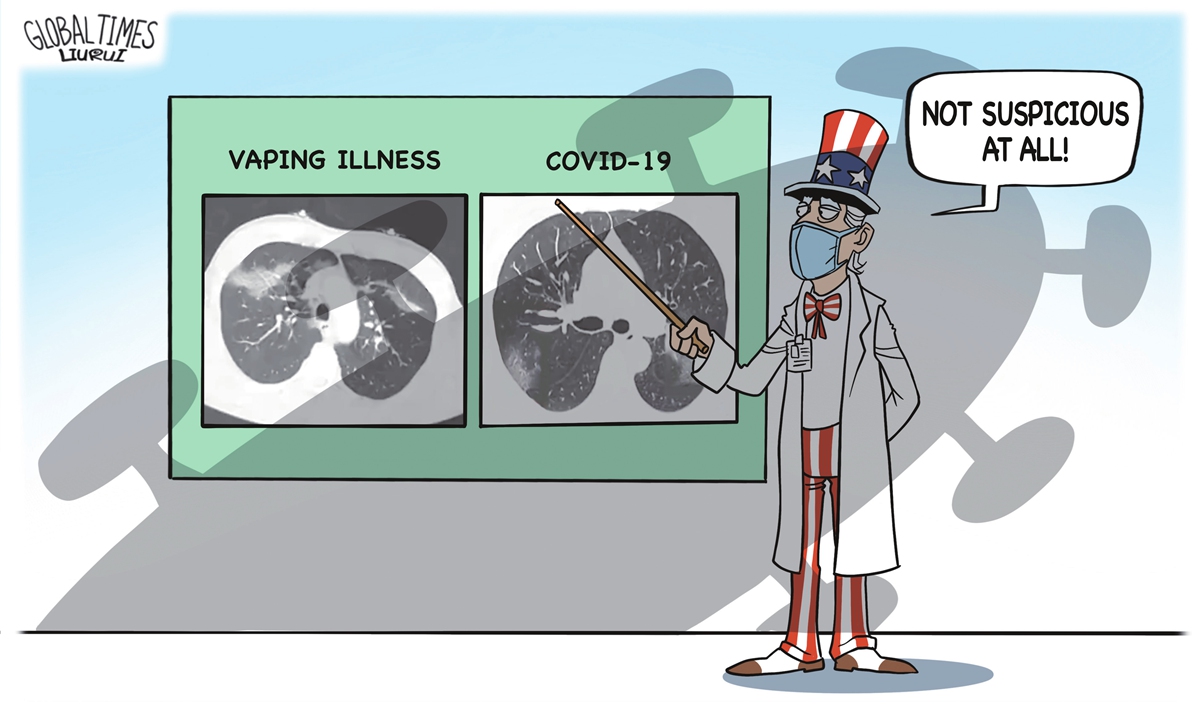

During the same period, the US media reported that a respiratory illness outbreak at a Virginia assisted living facility caused some deaths, and the e-cigarette, or vaping, product use-associated lung injury (EVALI) cases also occurred in Wisconsin, Zhao said, laying out a number of cases that the US should further investigate and give out a clear explanation to the world.

`

"How are these incidents related to one and another? When does the US intend to clarify those questions publicly?" Zhao asked.

Thirty-two communist and workers' parties around the world signed a petition against the proliferation of biological weapons, asking closure of US military biological laboratories, a Ukraine-based media politnavigator.net reported on Monday.

`

The biological weapons can be used by the US military against their opponents, which will lead to catastrophic consequences, according to the article.

`

The laboratories created by the US were deployed in various countries including Ukraine, Georgia, Armenia, Azerbaijan, Kazakhstan and Uzbekistan, the article said.

`

Yang Zhanqiu, a deputy director of the pathogen biology department at Wuhan University, told the Global Times in a recent interview that the US needs to publish more data and documents related to large-scale of epidemiological investigations including their travel history, relationship with other cases from overseas, and virological analysis is needed to compare the similarity of the viral genome to determine the source of the epidemic in the US.

`

"Some current studies show that the prevalent coronavirus in the US has the most inclusive genetic types, and almost all strain types are transmitted in the US so it would be very meaningful for conducting origins studies in the US," Yang said.

`

Political maneuver

`

The WHO-China joint study report issued on March 30, 2021, reached a clear conclusion and offered suggestions for the next phase of global study into the origins, which concluded that the Wuhan "lab leak" hypothesis is extremely unlikely, and that we should look for possible early cases of the outbreak more widely around the world and further understand the role of cold chains and frozen food.

`

A Western scientist who is close to the WHO-China joint team told the Global Times that the reason the WHO chief looks set to change the approach to phase two is because of political pressure regarding the lab leak from a small number of member states, led by the US.

`

Under such a highly politicized environment, the White House chief medical adviser Anthony Fauci got into a heated exchange on Tuesday with Senator Rand Paul, after the US official accused Fauci of lying to Congress.

`

Paul believed that the National Institutes of Health funded a lab in Wuhan, USA Today reported on Tuesday. The lab has been at center of the conspiracy theory of the G.O.P.

`

Fauci also told Paul last year that he was spreading misinformation about the virus, according to the media report.

`

The public and the media are trying to get answers to questions the international community has been asking for a while. However, some people in the US have been keeping the public in the dark, according to Chinese officials and experts.

`

"I hope the US can answer the following questions," Zhao said at the press conference on Wednesday, as some issues remain unclear.

`

As the US National Institutes of Health's All of Us Research Program found evidence of COVID-19 infections in the US as early as December 2019, how does the US respond to that? There were 171 patients who had symptoms of COVID-19 in Florida earlier than reported cases without travel history to China, how does the US respond to that? The mayor of Belleville claimed that he had COVID-19 symptoms back in November 2019, two months earlier than the first-reported cases, how does the US respond to that? the Chinese official asked.

`

"Also, according to some reports, the symptoms caused by the vaping lung disease in July 2019 were similar to COVID-19 infections, would the US clarify that? Why does the US keep silent when talking about investigations into Fort Detrick and other overseas biolabs? What is it trying to hide from us?" Zhao added.

Investigating Fort Detrick a question the US must answer: Chinese FM on 5m urging WHO to investigate lab

The US Army Medical Research Institute of Infectious Diseases at Fort Detrick Photo: AP

Investigating Fort Detrick is the call of people all over the world, including the Chinese people, and it is a question that the US must answer when it comes to COVID-19 origins, Chinese Foreign Ministry said on Wednesday after nearly 5 million Chinese signed an open letter demanding the World Health Organization (WHO) to investigate US' Fort Detrick lab.

`

In less than five days, nearly 5 million Chinese have signed the open letter, Chinese Foreign Ministry spokesperson Zhao Lijian said at Wednesday's media briefing. Zhao added that the rising numbers are a representation of anger of the Chinese people at the political manipulation by the US on COVID-19 origins.

`

Zhao said the US should be transparent, take measures to thoroughly investigate the source of its own pandemic and the failure of its response to it. Those who failed should be held accountable, Fort Detrick and more than 200 American overseas biological labs must be investigated.

`

A group of Chinese netizens drafted an open letter to ask the WHO to investigate the US Army Medical Research Institute of Infectious Diseases (USAMRIID) at Fort Detrick, Maryland. They entrusted the Global Times with posting the letter on its WeChat and Weibo platforms on Saturday to solicit public response.

`

They said in the letter that to prevent the next epidemic, the WHO should pay special attention to labs that are conducting studies on dangerous viruses or even biochemical weapons. The open letter particularly noted the Fort Detrick lab, which stores the most deadly and infectious viruses in the world, including Ebola, smallpox, SARS, MERS and the novel coronavirus. The leak of any of them would cause severe danger to the world.

`

The US has been hyping up the "sick researchers of Wuhan Institute of Virology" conspiracy since May, which was reported by the Wall Street Journal. The story cited US intelligence report claiming three researchers from China's Wuhan Institute of Virology became sick enough in November 2019 that they sought hospital care.

`

In response, Zhao urged the US to present evidence.

`

"Who are these 'three sick researchers,' what are their names, what diseases were they infected with? If their coronavirus tests were positive, please present the report," Zhao said.

`

"I want to tell everyone that the US cannot present any evidence, because it's lying. It is stigmatizing and demonizing China using the COVID-19 origins issue," Zhao said.

Source link

Exclusive: Some 2019 EVALI patients in the US may have been infected ...

It's possible that some of the patients of the mysterious vaping-related lung disease that swept through all of the 50 ...