In the upcoming days, they will enjoy the happiness and joy of the "long holiday," which they have earned through their hard work.

Meanwhile, across the ocean in the US, this year's October 1 is a critical day.

Federal government agencies will run out of funds previously approved by Congress at midnight on September 30, the end of the current fiscal year. A government shutdown due to the bipartisan inability to reach an agreement seems inevitable.

For the rest of the world, this situation appears to be a farce of a commonplace American political struggle. People are not concerned about whether Washington will shut down. Where exactly is the US debt ceiling? This is what worries them. Can it continue to rise indefinitely?

The US has not defaulted on its national debt in the past, which is why US debt has become the most reputable in the world. But it has now reached an alarming height - $33 trillion! That amounts to $100,000 per person across the nation! What's even more concerning is its growth rate, with an increase of $10 trillion in three years! That means $833 million is being added to the debt every hour since it crossed the $33 trillion mark.

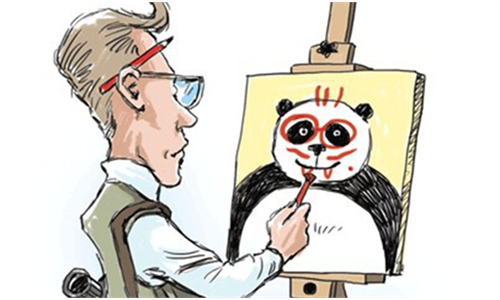

A nation that frequently accuses other countries of creating debt has set a huge trap for the world in recent decades. Let us not overlook the fact that the US possesses the power to "print money," which it uses to sustain Washington's audacious habit of borrowing and spending recklessly, exemplifying its dominant "style" of hegemony. Government finances in the US have struggled for nearly half a century due to excessive spending without proper control, resulting in the continuous accumulation of federal government debt.

In the realm of election politics and hegemonic policy, the US has wasted significant financial resources. These resources have been used to cater to the interests of interest groups and self-serving politicians. Consequently, there has been an excessive increase in military expenditures to sustain hegemony, along with a continuous distribution of funds to appease voters.

Filippo Gori, an economist at the Organisation for Economic Co-operation and Development, has published an article entitled "America's Debt-Ceiling Disaster: How a Severe Crisis or Default Could Undermine U.S. Power," on the website of Foreign Affairs magazine (April 24, 2023).

The article points out that "because most international trade is in U.S. dollars, the United States can print money to pay for goods that it buys from abroad, allowing it to finance a large international trade deficit without having to worry that it will run out of cash."

This monopoly advantage, known as "too big to fail," has resulted in a peculiar situation where the US is "insolvent" but not officially bankrupt. As a result, the US must employ diverse strategies to uphold the dollar's dominance.

Another fundamental truth is that when the global community thinks about how the impact of this "Grey rhino" can be prevented and begins to make necessary preparations, the hegemony of the US and its foundation, the dollar, will surely be shaken.

China is a significant creditor of the US. The US' containment of China, particularly through creating military tensions in China's neighborhood, as well as the overall restriction on Chinese manufacturing and its impact on the livelihoods of the Chinese people, has heightened China's worry about the US reneging on its debts.

The hardworking Chinese people, who are about to enjoy a wonderful holiday, know that they work hard for the well-being of their families. If their hard-earned money were to be used to prop up an empire's hegemonic and brutal actions, as well as an unsympathetic political struggle, and then they were to be paid back in the form of "printed money," they would definitely say "no."

We believe that hard-working people around the world would share the will of the Chinese people.

RELATED ARTICLES