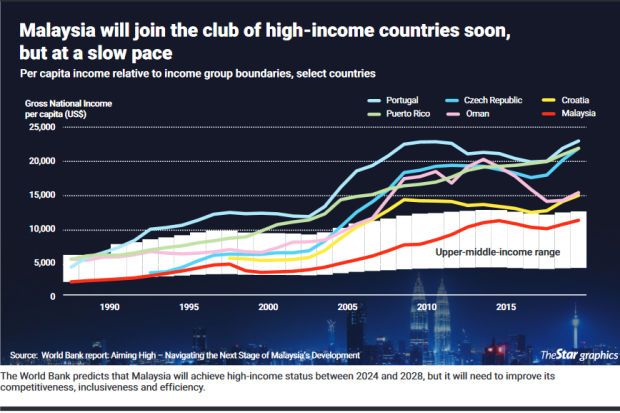

Malaysia is likely to make the transition from an upper middle-income economy to a high-income economy within the next five years despite setbacks from the Covid-19-induced recession, says a new World Bank report.

However, according to the “Aiming High: Navigating the next stage of Malaysia’s development” report, Malaysia is growing slower than many countries that have achieved high-income status in the past.

“Compared to many other countries that have graduated from middle-income status, it has a lower share of employment at high skills levels and higher levels of inequality.

“And compared to countries in the OECD (Organisation for Economic Co-operation and Development), Malaysia collects less in taxes, spends less on social protection and performs relatively poorly in terms of measures related to environmental management and the control of corruption, ” it said, adding that many of these fault lines were exposed during the pandemic.

Malaysia, it said, had been severely affected by Covid-19, adding that it would take “several years before the scars of the pandemic are fully erased”.

The 196-page report is expected to be launched today by Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz in a virtual event that will also see Minister in the Prime Minister’s Department Datuk Seri Mustapa Mohamad delivering his special address on Malaysia’s next development plan.

The report said policies that had enabled Malaysia to successfully transition from low to middle-income would need to be adapted to meet future challenges, adding that these policies and institutions which had worked in the past might no longer be appropriate.

Malaysia’s transition, it said, was also subject to a number of significant downside risks, especially the high level of uncertainty over what would be the “new normal” after Covid-19 and how this would impact the country.

“The Asian Tigers that achieved high-income status in past decades did so in a more benign international environment.

“Malaysia faces not only a global pandemic and a worldwide recession but also a looming international debt crisis, a heightened risk of a resurgence in trade disputes, the potential unravelling of global value chains, and the impact of disruptive technologies that will change the nature of comparative advantage, ” it said.

Domestically, Malaysia also faced ongoing political uncertainty and a significant increase in government debt from financing the economic measures to help the rakyat during the Covid-19.

While it was normal for Malaysia to experience decelerating growth before Covid-19 as it achieved a higher level of development, it appeared to have slowed down more than it should have relative to its potential.

“The country must adopt a new course for greater knowledge-intensive and productivity-driven growth. In this context, the Covid-19 crisis might usefully provide an opportunity to undertake much-needed reforms, ” it said.

The report also noted that as Malaysia positioned itself for the next phase of development and beyond the pandemic, many of the issues related to this transformation were being addressed and discussed, including through the 12th Malaysia Plan and the Shared Prosperity Vision 2030.

“With the impact of the Covid-19 pandemic and its potential to depress growth into the future, issues related to Malaysia’s readiness for the future have become even more significant, ” it added.

Quality better than quantity in foreign investments

KUALA LUMPUR: As Malaysia looks to transform its economy, there is also a need to reorient its practices and policies to attract quality foreign investments that would help the nation achieve its aspirations.

According to World Bank Group lead economist for Malaysia Richard Record, (pic below) the country is now focusing more on quality investments rather than in quantity.

“It is becoming clear that Malaysia is now looking to attract a different type of investment. In the past, Malaysia was at a low level of development and there was a lack of capital. So foreign investment was an important source of investment.

“Now, it’s less so about that, and more about the types of technology, management practices, job creation and opportunities to move into new areas of competitive advantage.

“So Malaysia is looking for something a little bit different from foreign investment now and there’s an opportunity here to rejig some of the policies towards that attraction of quality investments, ” he said.

These reforms include improving speed and transparency in investment approvals and incentive offerings.

Record noted that moving towards an automated approval process would put Malaysia at the forefront.

There is also a need for a more coordinated promotional effort. While Malaysia has a lot to offer investors, Record noted that there were many institutions competing in parallel. Thus, a more coordinated approach would yield a higher return on investment.

According to a United Nations Conference on Trade and Development report, the inflow of FDI into Malaysia dropped by 68% last year.

However, Malaysia is not an isolated case as the report noted that global FDI collapsed in 2020, falling 42% to an estimated US$859bil from US$1.5 trillion in 2019.

“Malaysia is a highly open economy and is exposed to international business cycles. So it is inevitable that we saw a reduction in investment flows to Malaysia last year, ” said Record.

Meanwhile, World Bank Group country manager for Malaysia Firas Raad noted that Malaysia’s fiscal position coming out of the recovery will be somewhat constrained.

Hence, there will be a higher reliance on private investment.

“We are in a highly competitive environment because every government around the world is trying to attract investments. So this is where serious reforms and initiatives have to be implemented to make sure that Malaysia’s offering is really competitive with the countries we see in the region, ” he said.

Related:

Next generation reform plans

Malaysia to Achieve High Income Status Between 2024 and 2028, but Needs to Improve Quality, Inclusiveness and sustainability of Economic Growth to Remain Competitive