| |||

| Cryptocurrency and Facebook logo are seen together in this photo. Photo: IC |

https://youtu.be/eAPLA4oy7Ks

Experts raise concerns over privacy and regulation

Facebook unveiled plans Tuesday for a new global cryptocurrency called Libra, pledging to deliver stable virtual money that lives on smartphones and could bring over a billion "unbanked" people into the financial system.

The Libra coin plan, backed by financial and nonprofit partners, represents an ambitious new initiative for the world's biggest social network with the potential to bring crypto-money out of the shadows and into the mainstream.

Facebook and some two dozen partners released a prototype of Libra as an open source code for developers interested in weaving it into apps, services or businesses ahead of a rollout as global digital money next year.

The nonprofit Libra Association based in Geneva will oversee the blockchain-based coin, maintaining a real-world asset reserve to keep its value stable.

The Libra Association's Dante Disparte said it could offer online commerce and financial services at minimal cost to more than a billion "unbanked" people - adults without bank accounts or those who use services outside the banking system such as payday loans to make ends meet.

"We believe if you give people access to money and opportunity at the lowest cost, the way the internet itself did in the past with information, you can create a lot more stability than we have had up until now," Disparte, head of policy and communications, told AFP.

Facebook will be just one voice among many in the association, but is separately building a digital wallet called Calibra.

"We view this as a complement to Facebook's mission to connect people wherever they are; that includes allowing them to exchange value," Calibra vice president of operations Tomer Barel told AFP.

"Many people who use Facebook are in countries where there are barriers to banking or credit."

But the move raised questions about how such a new money would be regulated, with one lawmaker calling for a pause on Libra.

"Given the company's troubled past, I am requesting that Facebook agree to a moratorium on any movement forward on developing a cryptocurrency until Congress and regulators have the opportunity to examine these issues," said Maxine Waters, chair of the financial services committee in the US House of Representatives.

Meanwhile French Finance Minister Bruno le Maire said such digital money could never replace sovereign currencies.

"The aspect of sovereignty must stay in the hands of states and not private companies which respond to private interests," Le Maire told Europe 1 radio.

Bank of England Governor Mark Carney said Facebook's new currency would have to withstand scrutiny of its operational resilience and not allow itself to be used for money laundering or terror financing.

ING economists Teunis Brosens and Carlo Cocuzzo said in a research note it was not clear what Libra was or how it might be overseen while US Senator Sherrod Brown, a Democrat and banking committee member, voiced concerns over Facebook's checkered record on protecting users' privacy.

Backed by real cash

Libra Association debuted with 28 members including Mastercard, Visa, Stripe, Kiva, PayPal, Lyft, Uber and Women's World Banking.

Calibra is being built into Facebook's Messenger and WhatsApp with a goal of letting users send Libra as easily as they might fire off a text message.

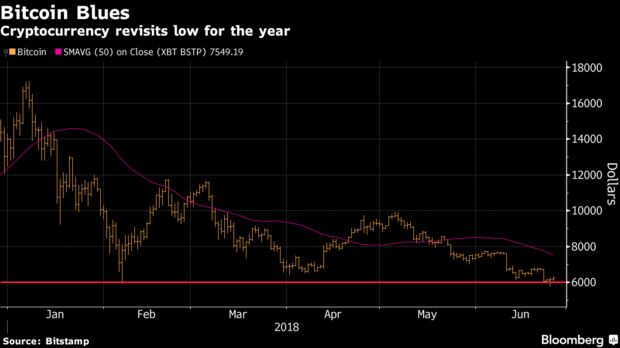

Libra learned from the many other cryptocurrencies that have preceded it such as bitcoin and is designed to avoid the roller-coaster valuations that have attracted speculation and caused ruin.

Real-world currency will go into a reserve backing the digital money, the value of which will mirror stable currencies such as the US dollar and the euro, according to its creators.

"It is backed by a reserve of assets that ensures utility and low volatility," Barel said.

The Libra Association will be the only entity able to "mint or burn" the digital currency, maintaining supply in tune with demand and assets in reserve, according to Barel.

"It is not about trusting Facebook, it is effectively trust in the association's founding organizations that this is independent and democratic," Disparte said.

New directions

The launch comes with Facebook seeking to move past a series of lapses on privacy and data protection that have tarnished its image and sparked scrutiny from regulators around the world.

Chief executive Mark Zuckerberg has promised a new direction for Facebook built around smaller groups, private messaging and payments.

The new Calibra digital wallet promises eventually to give Facebook opportunities to build financial services into its offerings, offer to expand its own commerce and let more small businesses buy ads on the social network.

"We certainly see long-term value for Facebook," Barel said.

Facebook said it would not make any money through Libra or Calibra, but rather was seeking to "drive adoption and scale" before exploring ways to monetize the new system.

Financial information at Calibra will be kept strictly separate from social data on Facebook and won't be used to target ads, Calibra vice president of product Kevin Weil told AFP.

Libra will be a regulated currency, subject to local laws in markets regarding fraud, guarding against money laundering and more, Weil said.

'Watershed' moment?

According to Facebook and its partners, local currencies and Libra may be swapped at currency exchange houses or other businesses.

And the ubiquity of smartphones means digital wallets for Libra could make banking and credit card services and e-commerce available in places where they don't now exist.

Analyst and cryptocurrency investor Lou Kerner said Facebook's move has the potential to open the door for cryptocurrency to a wider public.

"What Facebook is really good at, is making things really simple to use," Kerner told AFP.

"And that's what is super exciting for the crypto industry, is somebody comes along who understands user experience and has billions of users that they can roll this out to."

Source link

Read more :

China cannot be absent from the era of global digital currency competition

Last week, Facebook released an official white paper for its cryptocurrency project Libra, a blockchain-powered stablecoin expected to arrive in 2020.- In dealing with Facebook, FTC should shun pricey settlement in favor of bigger, riskier move

- Blockchain executive aims to sway Buffett on cryptocurrency sector

- Chinese blockchain entrepreneur aims to convince Warren Buffet on cryptocurrency at charity lunch

- Bitcoin miner fined, jailed for stealing electricity

- Bitcoin industry shakes as policy tightens

Bitcoin surges above US$11,000 as memories of popped bubble fade ...

https://www.bnnbloomberg.ca/bitcoin-climbs-above-11-000-as-memories-of-popped-bubble-fade-1.1277323