https://youtu.be/SA2wG5st0rk

Billionaire Jack Ma has declared Bitcoin a potential bubble, reiterating his caution over the volatile crypto-currency as his Ant Financial on Monday launched blockchain-based money transfers between Hong Kong and the Philippines.

The founder and chairman of Alibaba Group Holding Ltd. extolled the possibilities of the decentralized ledger on which Bitcoin is based but warned that the digital currency itself may be driven by torrid speculation. Ma made his comments after officially launching a blockchain-based remittance service with Standard Chartered Plc and GCash, Ant’s venture with the Philippines’ Globe Telecom Inc.

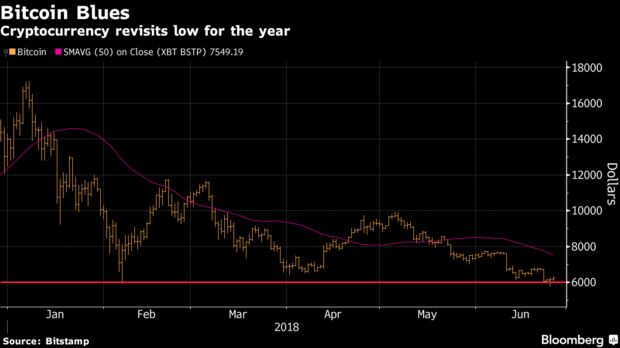

Bitcoin set a 2018 low on Sunday before bouncing back a tad, underscoring the volatility that stems from increased scrutiny by regulators even as global central bankers and business chiefs raise questions about its viability.

“Blockchain technology could change our world more than people imagine,” Ma told reporters in the former British colony, home to a large population of Filipino workers and domestic helpers who send money home regularly. “Bitcoin however could be a bubble.”

Read more: Ant Financial Raises $14 Billion as Funding Round Closes

Ant Financial, an affiliate of Alibaba’s backed by some of the biggest names in global finance and investment, has explored blockchain technology for years, including to clean up China’s murky charities. But the remittance service marks one of the first instances of the internet giant using the technology in mainstream finance.

On Monday, Ma also took potshots at the traditional banking industry, saying financial institutions were over-charging for overseas payments. Ant Financial, blocked from buying Moneygram International Inc., now wants to build something better and take blockchain-based remittances beyond just Hong Kong to the Philippines. He didn’t elaborate.

“Traditional financial institutions serve 20 percent of people and make 80 percent of profits. New financial institutions should service 80 percent of people, and make 20 percent of profit,” said Ma.

Read more: Jack Ma’s Too-Big-to-Fail Financial Giant Faces a Clampdown

By Lulu Yilun Chen Bloomberg

Bitcoin Drops Back Below $6,000 as 2018 Loss Approaches 60%

Bitcoin briefly dropped back below the $6,000 threshold breached this past weekend, bringing the loss for 2018 to almost 60 percent.

The world’s largest cryptocurrency by market value traded as low as $5,988, and was down 2.2 percent to $6,044 as of 10:56 a.m. in New York. Bitcoin last traded at this level in February.

Jack Ma Embraces Blockchain for Ant But Warns of Bitcoin Bubble

Bloomberg

Jack Ma Embraces Blockchain for Ant But Warns of Bitcoin Bubble

Alibaba's Jack Ma says bitcoin is 'likely' a bubble while embracing its ...

Jack Ma Claims Bitcoin is a Bubble, not Blockchain - Google News ...

Alibaba chairman advises staying away from bitcoin

Jack

Ma, whom is a controlling shareholder in Ant Financial - which is the

financial technology affiliate of Alibaba, advises staying away from

investing in bitcoin.

Jack Ma Claims Bitcoin is a Bubble, not Blockchain

by

Muffie Rojas | Jun 26, 2018 | Uncategorized |. Jack Ma Claims Bitcoin

is a Bubble, not Blockchain. This story was shared from this site. Jack

Ma went to the ...

Alibaba's Ant Financial Just Launched a Blockchain-based Remittance Service

Though

Alibaba co-founder Jack Ma may think Bitcoin is in a bubble, the firm

still believes in blockchain, the technology underlying

cryptocurrencies.

Jack Ma witnesses blockchain-based project, gushes over future of blockchain tech

Ant

Financial, company formerly known as Alipay and affiliate of the

Chinese Alibaba Group, launched their blockchain-based electronic wallet

cross border ...

Alibaba's Jack Ma: Bitcoin Is 'Likely a Bubble'

Alibaba's

chairman Jack Ma says that the company is betting on blockchain, but

advises against investing in Bitcoin. Ma is the controlling shareholder

in Ant ...

Alibaba Founder Jack Ma Warns of Bitcoin Bubble

Founder

and Chairman of Alibaba Jack Ma recently spoke about his views on

cryptocurrencies, declaring Bitcoin an asset bubble and saying that

digital ...

Jack Ma of Alibaba Group Holding Ltd (NYSE:BABA) Sends Out A Warning Regarding An Impending Bitcoin Bubble

The

executive chairman of Alibaba Group Holding Ltd (NYSE:BABA) Jack Ma Yun

is quite pleased with the promise that pulls along with the underlying

...

Jack Ma: Technology by itself is not a bubble, but bitcoin is possible

He actively explores the potential of blockchain but avoids cryptocurrency.

Alibaba's billionaire chairman Jack Ma is warning about a bubble in bitcoin

Jack

Ma — the billionaire founder of China's online retail juggernaut

Alibaba — is less than convinced about bitcoin's value proposition. Ma

repeated his ...

Why exactly is Jack Ma calling Bitcoin a bubble?

One

of the most famous and prominent business people in the world has just

slammed Bitcoin. Jack Ma, the founder of Alibaba and the fintech company

Ant ...

Blockchain is world-changing but bitcoin is a bubble says billionaire

He

added that blockchain represents a solution for security and privacy,

as well as processing capabilitiies for the millions of transactions

that Alibaba completes ...

Alibaba Co-Founder Jack Ma Bashes Bitcoin, Leverages Blockchain Technology

Jack

Ma, co-founder of the Chinese technology conglomerate Alibaba Group,

has yet again raged against the bitcoin machine, calling it a

foreseeable bubble.

Ant Financial Launches Blockchain Based Money Transfer Services

Ant Financial recently launched a blockchain-based money transfer *service* between Hong Kong and the Philippines.

Jack Ma Embraces Blockchain for Ant But Warns of Bitcoin Bubble

The

Chinese investor, who is worth almost $50bn (£37bn), said: "Blockchain

technology could change our world more than people imagine, adding that

"Bitcoin ...

Jack Ma Of Alibaba Cuts Remittance Costs

The

one and only Jack Ma of Alibaba has revealed that Ant Financial

Services—an affiliate of the e-commerce company that is Alibaba is no

longer going to ...

Here's the Real Reason Jack Ma Called Bitcoin a Bubble

Bitcoin

prices were slightly up on the day even though Alibaba founder Jack Ma

said he believes the crypto coin is a bubble. But there's a big reason

why he ...

Alibaba's Jack Ma Warns Against Bitcoin; Pledges Support For Blockchain Technology

Once

again, the billionaire founder of Alibaba hails blockchain technology,

once again he expresses reservation towards cryptocurrencies suggesting

it could be ...

Stay Away From Bitcoin - Alibaba's Chairman

Share

this article: Stay Away From Bitcoin – Alibaba's Chairman. (Kitco News)

- Alibaba's billionaire co-founder and chairman Jack Ma said that he

has ...

Bitcoin news: 'BTC is a bubble' says Chinese billionaire Jack Ma in shock warning

BITCOIN may be the world's most talked-about cryptocurrency, but a Chinese billionaire has warned it is likely a 'bubble'.

Bitcoin Continues Tentative Comeback Despite Alibaba's Jack Ma 'Bubble' Warning

Investing.com

– Bitcoin continued its tentative comeback from its swing lower over

the weekend but sentiment remained fragile amid sluggish fund inflows.

Ant Financial Launches Blockchain-based Money Transfers Between Hong Kong and the Philippines

Billionaire

Jack Ma believes that blockchain can revolutionize the world and moves

from words to action: the affiliate of his Alibaba Group Holding has ...

Alibaba chief calls for bitcoin bubble but constructive on blockchain

Alibaba

Chairman Jack Ma says that he would stay away from bitcoin because it

could be a bubble but he reportedly seems to be constructive on the

blockchain.

Inside Bitcoins

Jack Ma Claims Bitcoin is a Bubble, not Blockchain