Gold medallists Team China (center), silver medallists Team USA (left), and bronze medallists Team France pose on the podium of the men's 4x100m medley relay final swimming event during the Paris 2024 Olympic Games on August 4, 2024. Photos: VCG

As Pan Zhanle miraculously, yet unsurprisingly, surpassed the French swimmer alongside him in the final 50 meters and touched the wall first, China's swim team secured the gold medal in the men's 4x100m medley relay.

The achievement upended the US's streak of winning gold in the event for 10 consecutive Olympics.

Twenty-two minutes later, the Chinese women's team clinched the bronze in the same event.

During the subsequent award ceremony, the swimmers from different countries gathered on the podium to celebrate and take selfies, marking the end of the swimming competition at the Paris 2024 Olympics.

Despite the smiles and flashing cameras, the recent controversies surrounding this swimming pool were hard to overlook.

Doping became a hot topic during the swimming events at the Paris 2024 Olympics. Some, including media sources from the US and the Western countries, seemed eager to seize on any opportunity to disparage Chinese swimmers by linking them to doping.

The issue appears to go beyond sports, raising suspicions about the underlying motives. At what should be a venue for peace and friendship, this has almost become a new weapon to attack China.

US media and institutions have incessantly hyped the issue of doping at the Olympics, using it as a pretext to attack the International Olympic Committee (IOC) and criticize the World Anti-Doping Agency (WADA).

However, on the contrary, doping issues involving athletes from the US often seem to be handled with much more leniency. In 2020, the US even passed the Rodchenkov Anti-Doping Act, positioning itself as an international enforcer to intervene in doping cases worldwide, particularly targeting other nations.

Behind the US and Western "anti-doping" narrative lies a complex power dynamic that manipulates the sports field for political gain. The Paris Olympics once again highlighted how doping tests have been weaponized, severely disrupting the normal conduct of the Games. The abuse of anti-doping measures to create chaos in the Olympics is a prime example of the US-led "liberal international order" based on selective rule enforcement.

Paris farce

In the just-concluded drama that seems more fitting for a political stage than a sporting arena, the US and its allies have once again turned their attention to doping allegations, this time targeting the Chinese swimming team at the Paris 2024 Olympics.

"I've lost count of how many tests I've done. I often get called for tests at 6 am," Qin Haiyang, a Chinese swimmer, candidly admitted during the press conference following the Paris Olympics' 4x100m mixed medley relay final on Saturday, where the Chinese team won silver, breaking the Asian record. "It really does impact our entire preparation rhythm," he added.

Earlier, Chinese swimmer Pan's victory in the men's 100m freestyle final at the Paris 2024 Olympics, with a time of 46.40 seconds, a fresh world record, drew suspicion from foreign media. On Friday, Chinese swimmer Zhang Yufei countered at an after-match press conference, asserting that Pan's performance was legitimate, questioning why no one scrutinized American swimmers Michael Phelps and Katie Ledecky.

Pau Gasol, former NBA player and a member of the IOC Athletes' Commission, expressed "regret" over the frequent doping tests faced by Chinese swimmers at a press conference during the Paris 2024 Olympics on Friday, calling for respect for WADA's authority and testing system.

According to the Chinese swim team, from May 5, when the team began training for the Paris 2024 Olympics, to July 22, the athletes underwent extensive international and domestic anti-doping tests, including both urine and blood tests, the Xinhua News Agency reported.

Zhang, Qin and several competitive swimmers were tested over 25 times each, while most other athletes underwent more than 20 tests.

An insider told the Global Times that China has maintained a strict stance against doping violations, with an enforcement rigor that is arguably the highest in the world and recognized internationally as a high standard. China's punitive measures are also unique, involving severe administrative penalties for those who violate doping regulations. It can be said that China has been genuinely committed to anti-doping efforts over the years.

IOC President Bach holds a regular press conference at the Paris Olympics on August 3, 2024. Photo: VCG

Compared to the frequent therapeutic use exemptions (TUE) applications by American athletes, China's requests for TUEs are notably few. This is also largely because doping has long been a zero-tolerance issue in China, the insider noted.World Aquatics noted that since January, each Chinese swimmer has been tested an average of 21 times by various anti-doping organizations. In contrast, Australian swimmers were tested an average of four times, and American swimmers six times.

Moreover, on Saturday, IOC President Thomas Bach emphasized that WADA and other authoritative bodies have the authority to decide the number of doping tests to ensure the fairness of Olympic competitions.

Smear campaign

As the proverb goes, you can never wake someone who pretends to be asleep. In the face of truth, some Western media remains willfully blind.

One of the US' favored strategies in recent years has been to incessantly hype suspicions of doping among Chinese athletes. This tactic, shrouded in a veneer of concern for fair play, often seems more like a calculated move to cast a shadow over China's sporting achievements.

The tactic is both incredibly disgusting and offensive, as no matter the frequency with which the international and Chinese official institutions have refuted and clarified the accusations, the US government, media, and opinion leaders just turn a blind eye and continue to maliciously smear China's credibility. With false accusations, they jointly conspire to draw the targeted Chinese athletes into an incredibly time-consuming and energy-draining self-justification trap, observers noted.

Several major mainstream media outlets have played an essential role in the US' chain of fabricating and spreading the "doping" accusation. The latest round of hype started from a July 30 article by The New York Times (NYT), which quoted two anonymous sources "with direct knowledge of the matter," as saying that two Chinese swimmers "tested positive in 2022 for a banned steroid," including one who was named to be in the Olympic team in Paris. It viciously hinted that the swimmer used drugs and was unqualified for the ongoing Olympics.

Regardless of WADA's responding statement on the same day, which dismissed the NYT's accusations, mainstream US media like The Associated Press soon joined in spreading the slander, by citing one-sided sources from among US swimmers who expressed "disappointment" in their Chinese competitors.

It's infuriating that self-claimed professional US news agencies play up anti-China sentiment in the Olympic arena while setting facts aside. "The politicization of anti-doping continues with this latest attempt by the media in the US to imply wrongdoing on the part of WADA and the broader anti-doping community," WADA said at the end of the statement, noting that it has been "unfairly caught in the middle of geopolitical tensions."

Similarly, before the Paris 2024 Olympics took place, the US had launched a round of misinformation campaign against Chinese swimmers, so as to exert public pressure on China and its athletes on the eve of this global sporting pageant.

In early July, some mainstream US media including the NYT, NBC, and CNN intensively reported that the US Federal Bureau of Investigation (FBI) and the Justice Department had opened a criminal investigation, into "how anti-doping authorities and sports officials allowed elite Chinese swimmers who had tested positive for a banned substance," to "escape punishment and win a slew of medals."

The case they mentioned was about United States Anti-Doping Agency claiming that 23 Chinese swimmers were suspected of using a banned drug in 2021. It's worth noting that, WADA and FINA (Fédération Internationale de Natation Association) had determined it was an accidental food contamination incident and absolved the involved swimmers after conducting an investigation, but the US government departments and media still hyped the case with misleading, suggestive language, which was "extremely rude and evil-minded," said observers in media and sports reached by the Global Times.

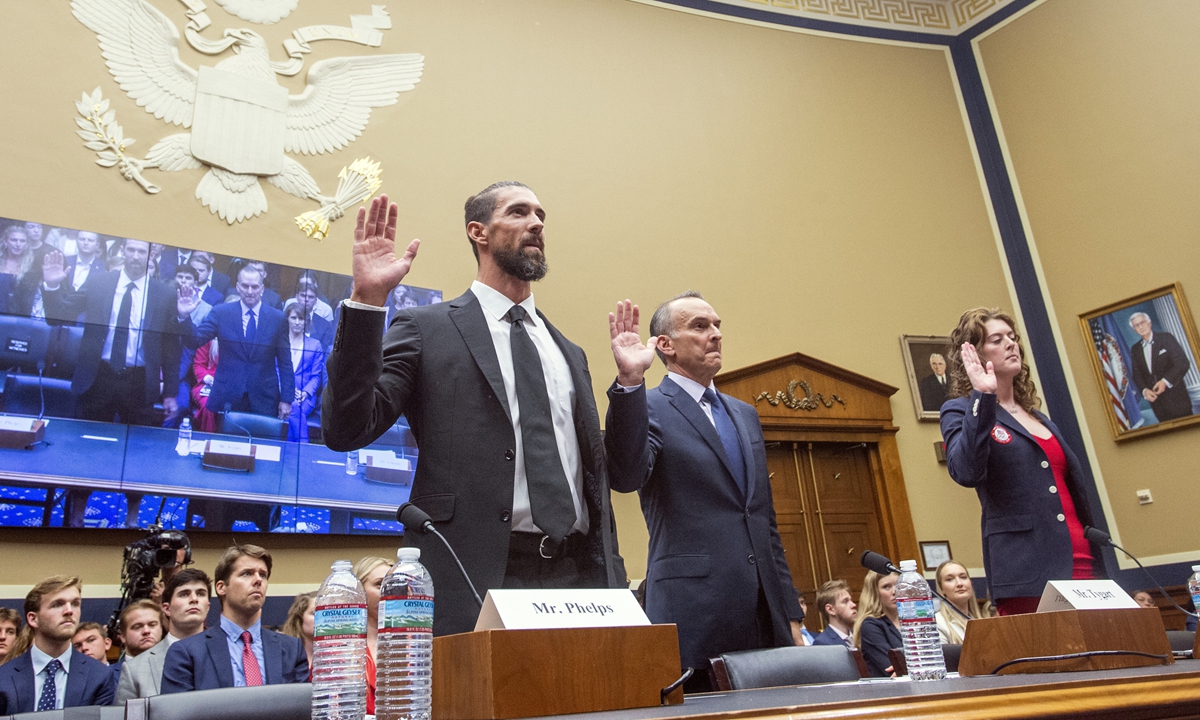

Michael Phelps (left), former Olympic athlete, Travis Tygart (center), Chief Executive Officer of the US Anti-Doping Agency, and Allison Schmitt, former Olympic athlete, are sworn in during a House Committee on anti-doping measures on June 25, 2024 in Washington DC. Photo: VCG

Worse still, US media publicly disclosed the complete name list of the 23 swimmers involved after they had been proven innocent. WADA prohibits making public the names of the innocent athletes who have been cleared of wrongdoing, Shang Ximeng, a research fellow at the Center for International Sport Communication and Diplomacy Studies at the Beijing Foreign Studies University, told the Global Times. She added that US media had seldom exposed the names of US athletes involved in similar cases."But this time, the media deliberately made the names of Chinese swimmers public and put them in the spotlight, so as to harm their reputation and bring disruption to their matches," she told the Global Times. "That was immoral and against the rules."

Weaponizing sports

American sports history is riddled with instances in which athletes caught using performance-enhancing drugs were shielded from consequences.

For example, at the 1996 Olympic trials, Mary Slaney tested positive for steroids but claimed her positive result was due to birth control pills. US authorities later believed her and reinstated her eligibility. Similarly, in 1998, Dennis Mitchell's positive drug test was absurdly attributed to excessive sex and beer, a flimsy excuse that was accepted.

The intersection of politics and sports has been a longstanding tool for the US to exert influence. In 1979, President Jimmy Carter called for a boycott of the 1980 Moscow Olympics, garnering support from 65 countries.

David Niven, a political science professor from University of Cincinnati, asserts that understanding American life requires understanding its politics and sports, noting a resurgence of political activism in sports.

Shang noted that funding is an another tool the US uses to exert its jurisdiction in sports. Contributing about $3 million annually to WADA, the US leverages this to attempt to place more Americans as decision-making roles in WADA, threatening to cut funding otherwise. The Rodchenkov Act allows the US to conduct independent investigations and levy penalties, causing unease for WADA and the IOC. This act places US legal standards above global anti-doping efforts.

However, the global anti-doping field continues to harbor persistent malice toward China. As China's strength has become increasingly apparent, it has faced baseless accusations for a long time. Today, China has earned the respect and recognition of WADA through its own integrity and rigorous anti-doping efforts, analysts said.

POWERE