Western media bias against China deplorable, dangerous

As the coordinated anti-China smear campaign is gaining steam, more intrepid journalists with a conscience are calling it out despite the tremendous pressure to silence them.

In one of the most excoriating rebukes against Western media's manipulation of the public opinion against China, Javier Garcia, head of the office of the EFE News Agency of Spain in Beijing, announced earlier this week that he would soon leave journalism, as the flagrant information manipulation by Western media "has taken a good dose of my enthusiasm for this profession."

The departure of journalists like Garcia is a giant loss to the industry, which is in dire need of introspection. For those who choose to stay and disagree with the highly biased and distorted reporting on China, they are usually confronted with a monolithic propaganda structure in the West to ignore, silence and discredit them.

The past few years have seen a lot of deplorable cases where anyone who dared to maintain objective and impartial positions on China were accused of being on the payroll of the Chinese government or even worse.

While they are working arduously to suppress impartial information and hoping it to pay off, some media in the West, especially in the United States, should expect that the chickens will come home to roost, as their own political order is at risk.

Even James Murdoch, son of right-wing media mogul Rupert Murdoch who owns FOX News, castigated U.S. media for amplifying disinformation that successfully sowed falsehoods.

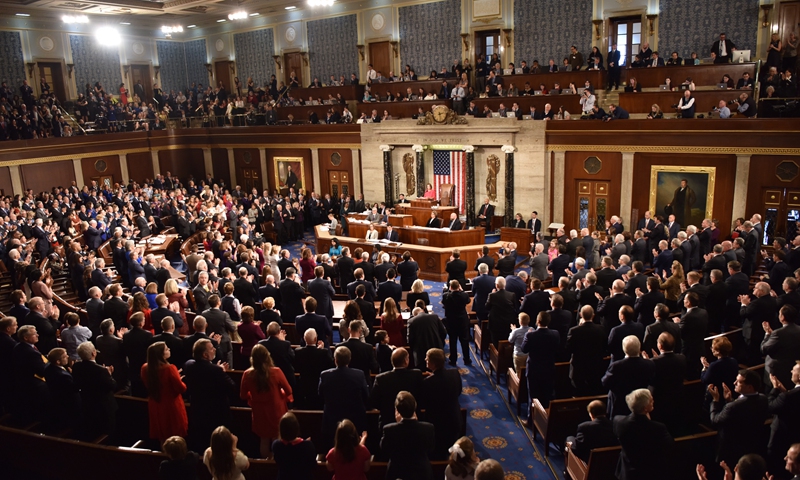

"Those outlets that propagate lies to their audience have unleashed insidious and uncontrollable forces that will be with us for years," he told the Financial Times shortly after the U.S. Congress riot in early January.

For those Western media who are still slandering China's peaceful development, it is time for them to think twice. Enditem Xinhua

Anti-China RSF has more actors than audience in its play against China

The French-based organization Reporters Without Borders (RSF) launched its Journalism Trust Initiative (JTI) transparency tool designed to "identify and reward trustworthy news sources" to combat false information. This online program requires the media to first conduct a self-assessment, which involves an internal check of conformity with the "JTI Standard." Next, the results may be "voluntarily disclosed to the public." The final stage of the process is an external evaluation by a third-party to certify a media as "trustworthy news sources." The supporters of JTI are basically Western news and social organizations, including major US internet companies and the "Association of Taiwan Journalists." Chinese and Russian news organizations are not involved.

The RSF describes JTI as "a game-changing transparency tool." However, the spread of information on the internet is based on another set of logic different from traditional media. It is questionable whether tradition media, with its declining influence, can regain the public's attention and influence by adding the tags of credibility.

The idea of JTI appeared in 2018. After the official launch in May, there was basically no actual response in the communication industry. Information about the project and how it operates is hard to come by on the internet.

I have again picked up such a topic that almost no one cares about, because the RSF is very anti-China. When it launched JTI, it obviously took the China factor into account, hoping that this online program, once becomes influential, can form another barrier to prevent Chinese voices from being heard in the international public opinion field. Its failure is destined.

Being full of ideological fanaticism, Western organizations such as RSF are fully hostile toward China, a socialist country. No matter what they do now, they will always regard damaging China as one of their goals. The world they want to shape is a spiritual kingdom irreconcilable with China. By forming and rewriting various "rules" and "standards," they will draw a gap between the world and China to demonstrate China's "self-isolation" which is incompatible with the so-called universal values.

In fact, the RSF is one of the worst liars in the contemporary world, and it has been committed to building an alliance of lies about China. Practice is the sole criterion for testing truth. The reality of China's vigorous development is a strong proof that China's path is not wrong. In their annual "world press freedom index," China is always listed at the bottom. But the public opinion field in China can always discover and expose various problems in time and generate public opinion and pressure to solve these problems.

In contrast, the public opinion field of the US and other Western countries has almost done nothing to promote solutions to their national problems. The concept of "freedom of the press" has long been hallowed out by them, becoming the lipstick on Western countries' face. By listing China's "press freedom index" at bottom, they aim at boosting their own morale and entertaining themselves.

On some fundamental issues in today's world, the Western public opinion regards position, instead of objectivity, as their priority. They do not hesitate to call white black. The COVID-19 epidemic has repeatedly caused humanitarian disasters in Western countries, but Western public opinion agencies have collectively regarded China, a country that has successfully fought the epidemic, as their first target of attack. The US and several other Western countries who have been waging wars have labeled China, a country that has not fought a war in several decades, a "threat" to world peace. Not only did US warships declare "freedom of navigation" by repeatedly crossing the Taiwan Straits, but even British warships have done the same despite being so far away from home. Obviously this is a provocation and a cheap trick, but it is falsely praised as "rules." Has the eyeballs and conscience of the Western media been dug out together?

The RSF is one of the many Western organizations that have smeared China the most. They have supported almost all attacks against China. They realized that it's not fun enough to oppose small countries. They believe they can have enough audience, show off as much as they want and set off unprecedentedly huge ideological storms by cursing China. Thus, they can finally find themselves something to do and develop a "career" that the entire West will fully support.

The RSF cannot control the internet. As I previously mentioned, a Western NGO cannot modify and reset the logic of the spread of false information on the internet. What the organization is really interested in is to create troubles for China, and it is much easier for them to find political and economic sponsorship by doing this. Their starting points may differ, but their political explanations to the West, especially to the US, will ultimately fall on creating an iron curtain of public opinion against China. This is the "value of their times" for Western ruling groups.

It seems that JTI has become an awkward play with more actors than audience. But organizations like the RSF are cheeky. Like a wild dog, it will haunt the road ahead of China from time to time. Therefore, we must carry a stick in our luggage when forging ahead.

The author is editor-in-chief of the Global Times. opinion@globaltimes.com.cn

The author is editor-in-chief of the Global Times. opinion@globaltimes.com.cn

Related posts:

West-backed color revolution a ‘top threat’ to China's national, political security

The US has found the world order quickly shifting and is feeling uneasy with the challenge from China. Beautiful diversity : Today,

Inside America's Meddling Machine destabilizing the world order

NED, the US-Funded Org Interfering in Elections Across the Globe

Splashing $10m a year to split and subvert China, US govt-backed foundation unabashedly reveals funding scheme

'We lied, we cheated, we stole', ‘the Glory of American experiment’ by US Secretary of State/Ex-CIA director Mike Pompeo

Moral vacuum at the heart of modernity, now embodied in US laws!

` ` MAN and nature are running out of time. That’s the core message of the UN Inter-governmental Panel on Climate Change ...

According to Bank Negara’s Financial Stability Review report for the first half of 2021, Malaysia’s household debt to GDP has declined to 89.6% from 93.2% as at end of last year. Although a small achievement,the household debt level remains elevated.

According to Bank Negara’s Financial Stability Review report for the first half of 2021, Malaysia’s household debt to GDP has declined to 89.6% from 93.2% as at end of last year. Although a small achievement,the household debt level remains elevated.