Trump was charged with 34 counts of falsifying business records in New York.

Share This

Sunday 2 June 2024

Donald Trump becomes 1st US president tried and convicted of crimes

A divide so hard to bridge

From the UiTM dispute to the annual matriculation issue, Malaysia seems caught in a loop of racial controversy. But there are those who give us hope.

THE SPM results are out. So, we can brace now for the annual lament of non-malays who will have top scorer children unable to get places in the public universities’ matriculation programmes.

It’s likely to be worse this year with more students scoring straight As and the number of matriculation places likely to be unchanged.

A Malay politician has already rushed in, telling the Malays who did not do well that they have nothing to worry about.

He is offering places in Giatmara, Mara and several other universities and colleges, promising them free education – and allowances to boot!

This, while other parents who are even willing to hold down two jobs to see their children get an education, are pleading for places. It must be frustrating for these parents.

The race divide in our country is very real.

The majority community and the minorities seem to be living in two different worlds, albeit in the same country. There’s already that controversy about Universiti Teknologi Mara and the parallel pathway programme for training cardiothoracic surgeons.

Despite close to 70 years of independence and more than 100 years of the various races and religions living together, we tend to know – or care – little about each other.

We even see “the other” as a joke to be laughed at, mocked, even bullied.

Take that teacher in Ampang. Four boys had thrown water bottles at each other. It is something quite ordinary – boys will be boys. So will teachers. When we were in school, we did not throw bottles, but teachers threw dusters. And they were unerringly accurate! They did not care about what race we were, that duster would land smack on the forehead of the errant lad.

This teacher in Ampang, though, does not seem so colour blind. He sent the four boys out to stand under the sun – no problem with that – but then called in three of them, reportedly of a different race, after just 15 minutes.

The other boy was left to bake for hours; he suffered a heatstroke and mental health problems. He has now been declared a disabled person and is unable to go back to regular school. The incident happened at the end of April, and as we go into June, we are told that no action has been taken against the teacher.

The boy’s mother, pregnant with another child, is devastated.

There was another mother who was devastated late last year. She had forgotten her two-year-old child and left the toddler in her car while she went about her work. That was on Nov 8. The grief-stricken mother was charged in court on Dec 22. It took the cops just a month and a half to charge a mother who had accidentally left her child in a hot car.

But the Ampang case was not an accident. It was malicious, as far as reports go. Yet, there seems to have been no real action so far although, according to the Ampang Jaya district police, the probe into the case has been completed and the investigation papers have been referred to the deputy public prosecutor.

What’s worse, the boy was served with warning letters for being away from school while he was getting medical treatment. Did the headmaster know that?

And there is that big question: Was the teacher racist? Was the difference of punishment due to the difference in race?

It should not be. Remember our current Prime Minister’s famous speech about “anak Melayu, anak Cina, anak India, anak Kadazan, anak Iban”? It was Gettysburglike, something we should all hold him to.

There can be no racism in schools. We don’t need people like that teacher in the system. What we could do with are people like Michael Tong Wai Siong.

For the last 16 years, the now 55-year-old has played father to three Malay boys. He first saw one of them when he was a 39-year-old visiting an orphanage in Gombak, Selangor.

The boy, who had learning difficulties, was sitting alone. Tong took him under his wing, putting him through tuition classes to make school easier. He also took the boy home.

Not only that, he also “adopted” the boy’s two brothers who were in a different orphanage.

He raised them as good Muslims, getting them an ustaz for religious classes and even preparing the early morning meals for the boys during Ramadan. It is heartwarming.

There was also Chee Hoi Lan, who was given the Ikon Ibu Sejatikeluarga Malaysia award in 2022. She raised a child who was abandoned at the age of two months by her biological mother, an Indonesian citizen.

Chee, a kindergarten teacher, adopted the child and single-handedly raised her as a good Muslim for 24 years now.

Both Tong and Chee are true Malaysians who understand what multiculturalism is.

I would love it if we could get more such heartwarming stories, especially the other way around. Wouldn’t it be wonderful to also hear of a Muslim who raises a non-muslim child in the religion of his or her birth?

There is also hope in people like 20-year-old Chinese lad Jeremy Wong Jin Wei and 24-year-old Malay-pakistani Zubir Khan.

Wong is Chinese but is as Indian as they come. He loves Tamil movies and Tamil songs and speaks the language fluently. He even has a couple of Indian names he has given himself – Jerogunathan Wongasamy, and Jerthalaiva Wongbeng, his Tiktok moniker.

While Wong may love Tamil songs, Zubir has become a huge Tamil singer with his hit single Macha Macha Nee Ennoda Macha, which garnered 3.5 million views on Youtube in just over five months. He, too, is surrounded by Indian friends.

In a country wracked by apartness, people like Tong, Chee, Wongasamy and Macha Zubir show us one thing – in the midst of all the bleak news, there may yet be hope for our country.

Saturday 1 June 2024

China extends a TVET helping hand to Malaysia

Scholarships and training in courses ranging from EVs to robotics and AI available

WITH over 5,000 Malaysian students set to benefit from technical and vocational education and training (TVET) in China, Datuk Seri Dr Ahmad Zahid Hamidi has called it a “game changer” in skills learning and career advancement for youth.

The Deputy Prime Minister said 220 Chinese companies are offering 5,125 places to Malaysian students to undertake short- to long-term courses in TVET.

The “game changer,” he said, will enable Malaysian students to learn high-tech equipment skills and forge a promising career path in TVET, which would come with better salaries.

The “game changer,” he said, will enable Malaysian students to learn high-tech equipment skills and forge a promising career path in TVET, which would come with better salaries.

“They will receive training in China through the Malaysia-China Youth TVET Training Programme’s Finishing School approach, with all expenses covered.

“These collaborations focus on various advanced courses, particularly in the automotive sector, emphasising electric vehicles (EVs), renewable energy vehicles (REVs), robotics, the Internet of Things (IoT), and artificial intelligence (AI),” he told the media in Beijing on Wednesday night.

Ahmad Zahid is in the Chinese capital on the last leg of his 11-day trip to mark the 50th anniversary of Malaysia-China bilateral ties. Before Beijing, he was in Hong Kong and Shanghai.

It’s also his first official visit to China since becoming Deputy Prime Minister in December 2022.

On the TVET programme, Ahmad Zahid said the initiative stems from a collaboration between the National Organisation of Skilled Workers (Belia Mahir) and China’s TVET sector, particularly through the Beifang Automotive Education Group and Tang (M) International Education Group.

Earlier, he witnessed the signing of a memorandum of understanding between Malaysia and 114 Chinese firms to affirm the collaboration and facilitate TVET training for Malaysian students at the Beifang International Education Centre in Daxing, Beijing.

Also present were Deputy Foreign Minister Datuk Mohamad Alamin, Majlis Amanah Rakyat (Mara) chairman Datuk Dr Asyraf Wajdi Dusuki, GiatMara chairman Datuk Musa Sheikh Fadzir, Belia Mahir secretary-general and head of skilled youth Mohammad Rizan Hassan, Beifang International Education president Cao Zhenfeng and Tang International Education Group president Li Jinsong.

Ahmad Zahid, who is also the National TVET Council chairman, said the training quota includes 500 places for Malaysian Chinese students and 200 places each for Indian students, and those from Sabah and Sarawak.

“Graduates will later be absorbed into these Chinese companies that have invested in TVET in Malaysia, enhancing their employability and immediate job market readiness.

“In addition to the 2,000 positions provided by Beifang Automotive, we have also secured a further 3,125 places following our recent discussions; it now totals 5,125 opportunities for our students.

“These courses are worth some RM30mil, sponsored by Chinese firms. Our side will cover flight tickets and a basic Chinese language course provided by the Malaysia-China Institute (MCI),” he said, adding that the courses will be rolled out in phases through 2025.

He also thanked Beifang for its commitment to sending training equipment, including six EVs and hydrogen cars to GiatMara, to facilitate the practical learning of repairing EVs and REVs, along with the free training provided to underprivileged students and instructors from Malaysian TVET institutions.

Ahmad Zahid said Malaysia’s emerging development in TVET talent is a way forward for these graduates to earn premium salaries.

“The demand for skilled labour is high, and with the requisite skills, achieving a premium salary is feasible.

“This is a proactive and straightforward process. I hope Malaysian students will seize the opportunity to further their studies,” he said.

The graduates’ qualifications, said Ahmad Zahid, are recognised by the newly unified accreditation body comprising the Malaysian Qualifications Agency (MQA) and the Skills Development Department for TVET courses.

“Previously, the National TVET Council has approved a single accreditation body that will do the recognition, either at the certificate or diploma level.”

Between May 29 last year and May 28 this year, he said, 850 Malaysians have undergone skill enhancement training in China in fields such as EV, AI, industrial automation, and railway maintenance.

“China’s exemplary practices in TVET serve as a benchmark for Malaysia.

“We aim to focus on industry partnerships, practical training and relevant curriculum development, utilising modern and advanced training facilities to prepare our workforce for future challenges.

“I hope all parties in Malaysia and China will fully support the MCI and subsequently become partners of the Malaysian government in our efforts to strengthen Malaysia-China diplomatic relations through TVET,” he concluded.

How China Reinvented The Space Station!

&

China invites all countries to join in global development with Belt and Road cooperation to a new stage of high-quality development, while the US supports two wars

Thursday 30 May 2024

BLACK SHEEP IN BANKS, Employees you cannot bank on, Calls for banks to bolster cyberdefences

Cops believe black-sheep bank workers may be in cahoots with scammers

PETALING JAYA: Scammers posing as bank officials seem to have access to sensitive information, which raises the question: are they in cahoots with black sheep within financial institutions?These scammers seemed to be aware of the personal and financial information of people they target, using it to convince victims into buying into the ruse and parting with their funds.

Victims in several reported cases said the scammers appeared to be aware of details of their account balance and other data that was only known by their financial institutions.

Bukit Aman Commercial Crimes Investigations Department (CCID) director Comm Datuk Seri Ramli Mohamed Yoosuf said while scammers usually “fish” for information and adopt various deceptive tactics to hoodwink their victims into sharing information about themselves, police do not rule out the possibility of bank employees colluding with syndicates and feeding them such confidential data.

“We do not discount the possibility and probabilities of such complicity occurring. It can happen in any organisation, even in the police force or other enforcement or government agencies.

“There is probably no organisation that is pristine. There are bound to be bad apples among employees. However, we need solid evidence to prove this,” he told The Star.

ALSO READ : Calls for banks to bolster cyberdefences

Comm Ramli advised the public to regularly keep tabs on their accounts and promptly raise the alarm with the relevant authorities if they discover any discrepancies.

The same scrutiny should be applied by those who own assets such as land or other immovable property, he added.

In November last year, retiree SA Nathan received a call from a scammer who posed as a bank officer, just an hour after he called his bank to enquire about his credit card statement.

Thinking it was a genuine call from the bank, the 95-year-old divulged some banking information and ended up losing RM18,000 that was siphoned off from his credit card.

ALSO READ : Banking industry working with regulators, agencies to enhance customer security

Confused by the whole episode and in an attempt to seek clarification, the nonagenarian referred the scammer to his daughter, Getrude Nathan, 56.

The housewife received a call from the same scammer and was coaxed into revealing sensitive data. She lost RM20,000 that was charged to her credit card.

Depressed and overcome by their losses, Nathan who was in ill health at the time, passed away weeks later when his condition deteriorated.

In February, a 51-year-old man was puzzled as to how scammers found out about cash deposited into his bank account just days after he made a withdrawal from his Employees Provident Fund (EPF) account.

Fortunately, the man was suspicious and hung up.

ALSO READ : Bank Islam stops 1,632 fraudulent transactions, nearly RM11.7mil saved in four months

In March, two bank officers were arrested by Selangor police for allegedly aiding a scam syndicate in an online fraud. The duo allegedly supplied the scammers with dozens of mule bank accounts meant for moving funds from victims.

In 2014, a bank officer and her husband, both aged 34 at the time, were arrested and charged with fraudulently withdrawing almost RM78,000 from bank accounts belonging to three passengers and a crewmember of the ill-fated MH370 Beijing-bound flight that went missing on March 8 the same year.

Nur Shila Kanan, who was an employee of a bank at Lebuh Ampang, Kuala Lumpur, had transferred the funds to several other accounts before making withdrawals.

She was sentenced to six years’ jail while her mechanic husband Basheer Ahmad Maula Sahul Hameed received a four-year jail term and ordered to be whipped.

ALSO READ : What is vishing? New scam is making the rounds and you’re likely a target

The Association of Banks in Malaysia (ABM) said banks implement regular audits to examine transaction records and internal activity by employees while ensuring compliance with regulatory requirements.

ABM said these audits do not only identify potential security vulnerabilities but also ensure that bank staff observe statutory protocols.

It said upon employment, bank staff are bound by Section 133 of the Financial Services Act 2013 and Bank Negara Malaysia’s Management of Customer Information and Permitted Disclosures Policy Document. They are trained to uphold banking secrecy and possess knowledge on information security risk.

ABM also said access to personal customer information is strictly controlled and only limited to employees who require it in the course of performing their official duties.

It added that access is granted on a “need to know” and “need to use” basis to authorised personnel, who are subjected to strict authentication processes.

“Employees are granted access only to the specific systems and data needed to perform their job duties.

“Among the authentication procedures are the use of unique usernames and passwords to verify the identity of staff members.

“Comprehensive logging and monitoring systems can track and oversee when and who accessed sensitive or a specific data.

“These permissions are regularly reviewed and updated.

“Banks continuously monitor user activity within their systems, including tracking login attempts, accessed data and account modifications.

“All actions involving customer data are meticulously logged and recorded in audit trails, ensuring accountability. Such access to data is revoked when the bank staff is reassigned to other sections or leaves the organisation,” an ABM spokesman said.

It said banks also had whistleblower programmes where employees are encouraged and can anonymously report any suspicious activities or potential collusion with shady parties.

The spokesman said such reports are treated seriously and thoroughly investigated.

Calls for banks to bolster cyberdefences

PETALING JAYA: With rising cases of online fraud and unauthorised access of personal data, financial institutions should upgrade their security systems and engage cybersecurity experts to address such threats, said criminologist Datuk Dr P. Sundramoorthy.

He said apart from rogue bank officials complicit with scam syndicates, the other threat to sensitive data leakage are online hackers.

“Crime prevention initiatives and strategies do come with a cost. However, the mid-term and long-term benefits will eventually outweigh this cost.

“Banks must prioritise security and protect its customers by all means before more fall victim,” said Sundramoorthy, who is with Universiti Sains Malaysia’s Centre for Policy Research.

He said securing confidential information by having a comprehensive and multi-layered approach to cybersecurity and data protection is a primary security step banks should adopt.

He said there are several ways banks can help protect the personal financial data of their customers such as strong encryption, secure servers, firewalls and keeping software up to date to prevent data breaches.

Sundramoorthy told The Star that strict policies and regulations restricting access to customer data should be a bank’s priority.

He said banks should also limit which employees can access sensitive customer information and have strict data access policies in place.

“They must have a system using multi-factor authentication. There should be multiple steps to verify a user’s identity, such as a password plus a one-time code, making it harder for unauthorised access. There must also be frequent and consistent monitoring of transactions and accounts, alerting customers promptly if any suspicious activity is detected,” he stressed.

Sundramoorthy said banks should also constantly educate its clients on online security, to identify scams and other measures to protect their data and not solely rely on law enforcement to keep the public in the know.

Certified fraud examiner Raymon Ram, who specialises in financial forensics and fraud risk management, said the recent arrest of two bank officers who allegedly aided a scam syndicate underscores the importance of cybersecurity protocols.

The bank officers were nabbed in March for aiding a scam syndicate in online fraud.

Selangor police believe they supplied scammers with dozens of mule bank accounts meant for moving funds from victims.

Raymon said while banks in Malaysia had stringent security protocols to protect customer’s data, the case proved there were vulnerabilities that can be exploited through insider threats, corruption or online hacking.

“The risk of corruption and hackers exists and cannot be entirely discounted. Continuous improvements in cybersecurity protocols, adherence to standard operating procedures and rigorous enforcement of the Financial Services Act (FSA) 2013 are essential to mitigate these risks and maintain public trust in the financial system,” Raymon said.

He said the Personal Data Protection Act (PDPA) 2010, guidelines from Bank Negara and the FSA collectively provide a robust legal framework to safeguard customer data. He said the FSA mandates strict regulatory compliance, internal controls and oversight mechanisms to prevent misuse of information and ensure accountability within financial institutions.

Related stories:

Banking industry working with regulators, agencies to enhance customer security

Bank Islam stops 1,632 fraudulent transactions, nearly RM11.7mil saved in four months

What is vishing? New scam is making the rounds and you’re likely a target

Own a SME? Here’s 4 things you need to know about cybersecurity

‘Cyber security’ announcements to support AI framework

Cybersecurity reality check: How prepared are M’sian companies at warding off attacks?

China to be pioneer in building new global financial system: scholars

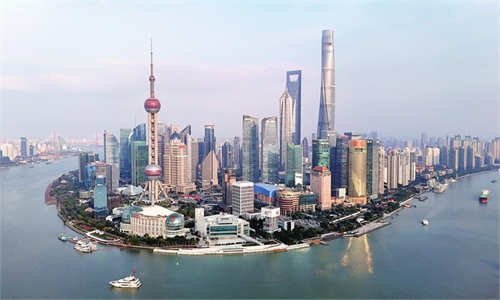

A view of Shanghai Photo: VCG

China will be a pioneer leading the world into a new and innovative financial and monetary system, as global calls for an overhaul of the Bretton Woods system - which has been in place for 80 years - gain traction due to the US abuse of the dollar's hegemony and its irresponsible policy, as well as a fragmenting global economy, Chinese and foreign scholars said.

The new financial system is envisioned to be one based on a diversified set of currencies rather than a single currency, they noted. It will be an open, inclusive system where the voices of emerging market economies would be better represented, and it will enable countries to join hands to promote global economic growth and financial stability.

The comments were made at the 2024 Tsinghua PBCSF Global Finance Forum in Hangzhou city in East China's Zhejiang Province. The two-day event concluded on Tuesday. This year, the forum was themed "80 Years after Bretton Woods: Building an International Monetary and Financial System For All."

"A system as old as Bretton Woods built after a world war is not the right proxy for the future forever and needs to be adapted… The world is undergoing geopolitical tensions, wars, demographic challenges and a climate crisis. We need to have one system going forward that includes everybody," Andreas Dombret, a global senior advisor at Oliver Wyman and former board member of the Deutsche Bundesbank, told the Global Times on the sidelines of the forum.

Dynamic emerging market economies such as China and India have grown in importance in the past decades, which needs to be reflected in their quotas in the IMF, he said.

Taking account of how the US has been weaponizing and abusing its dollar hegemony by imposing unilateral sanctions on other countries, attendees of the forum expressed hopes that a less dollar-centric system could be created from both a theoretical and pragmatic point of view.

The Federal Reserve's policies to deal with US inflation and a recession, which have had negative spillover effects on the world, have raised widespread concerns over an excessive reliance on a single currency.

"The Americans changed the Bretton Woods System in favor of the American economy [during the 80 years of development]. But we cannot sustain a global financial system based only on the one national currency, which is unsustainable," György Matolcsy, governor of the Central Bank of Hungary, told the Global Times in an exclusive interview on Monday.

A view of the 2024 Tsinghua PBCSF Global Finance Forum in Hangzhou, East China's Zhejiang Province, on May 28, 2024. The two-day forum ended on Tuesday. Photo: Li Xuanmin/GT

Massimiliano Castelli, managing director and head of strategy at UBS, said at a panel discussion on Monday that he has heard the view that although the US has mature financial markets and institutional credit, it is not a safe haven given its hegemonic positioning and reckless weaponization of its currency. If the world is subject to more geopolitical fluctuations, other countries may opt to reduce their reliance on the US dollar.

While the US dollar remains the world's most frequently used currency, de-dollarization has been gaining momentum, especially in emerging markets.

For example, China and Brazil agreed last year to trade in their currencies. In addition, a number of other countries including Russia, Malaysia, India, Saudi Arabia, Ghana and the United Arab Emirates have moved to settle trade in their local currencies.

As the global financial governance system is at a crossroads of adjustment and transformation, the scholars expect China - an active participant in global financial governance and policy coordination - to play a prominent role in making globalization more open, inclusive, balanced and mutually beneficial.

Although the yuan has a limited role in the international monetary system, it is expected to compete with the US dollar and become a substitute in the long run, they said.

"If the internalization of the yuan moves forward smoothly, the new system will be based on not only the US dollar but also on the euro and the yuan," Ju Jiandong, chair professor at the PBC School of Finance in Tsinghua University, told the Global Times.

The yuan accounts for a growing share of international payments. In March, the figure hit a record of 4.69 percent, up from 4 percent a month earlier, remaining the world's fourth most active currency ahead of the yen, data from global payment services provider Society for Worldwide Interbank Financial Telecommunication showed.

"I hope that we have a joint effort so that the global economy would not fall into two parts where one is competing with the other and making the global economy less effective. It would be best to have a global system that is deemed to be fair by everybody rather than having competing systems, which means a loss of competitiveness and a lot of loss of effectiveness," Dombret said.

Germany's central bank added the yuan to its currency reserves in 2018, a decision that Dombret said was significant, and he is confident that the share of the yuan in the mix of currency reserves will "grow."

Matolcsy suggested that Asian economies such as China, Japan, South Korea, India and Indonesia could create an Asian basket for central banks' digital currencies, offering the world a new border financial transaction system.

Russian President Vladimir Putin just visited China two weeks ago, his first overseas trip since his inauguration earlier ...

The nation's goal of building itself into a financial powerhouse has achieved progress in six key elements that ...

Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee, presided over a meeting of ...

Related posts: